When it comes to financial transactions, understanding the ABA number on a check is crucial for ensuring smooth transfers and payments. This unique routing code plays a vital role in identifying your bank during electronic transfers, direct deposits, or bill payments. Without a proper understanding of the ABA number, you might encounter delays or errors in your financial activities.

Many people are unaware of the significance of the ABA number or how to locate it on their checks. This guide will walk you through everything you need to know about ABA numbers, including their purpose, location, and importance in banking transactions. Whether you're setting up direct deposits or initiating wire transfers, having a clear understanding of this routing code can save you time and hassle.

By the end of this article, you'll have a comprehensive grasp of how to identify your ABA number on a check and the role it plays in your financial dealings. Let's dive in!

Read also:Can You Refund On Steam A Comprehensive Guide To Steam Refunds

Table of Contents

- What is an ABA Number?

- Where to Find the ABA Number on a Check

- ABA Number vs. Routing Number

- Common Uses of the ABA Number

- A Brief History of the ABA Number

- Using ABA Numbers in Digital Transactions

- Security Concerns with ABA Numbers

- Common Errors and How to Avoid Them

- Frequently Asked Questions About ABA Numbers

- Conclusion and Next Steps

What is an ABA Number?

The ABA number, also known as the American Bankers Association routing number, is a nine-digit code used to identify financial institutions in the United States. This code ensures that funds are routed to the correct bank or credit union during transactions. It was first introduced in 1910 by the ABA to streamline check processing.

The ABA number is essential for various banking activities, including direct deposits, wire transfers, and automatic bill payments. Each bank or credit union has its own unique routing number, which is assigned based on the location of the institution's headquarters.

It's important to note that while the ABA number is often referred to as the "routing number," these terms are interchangeable and mean the same thing. The routing number is always nine digits long and follows a specific format to ensure accuracy and security in financial transactions.

Where to Find the ABA Number on a Check

Identifying the Routing Number on a Personal Check

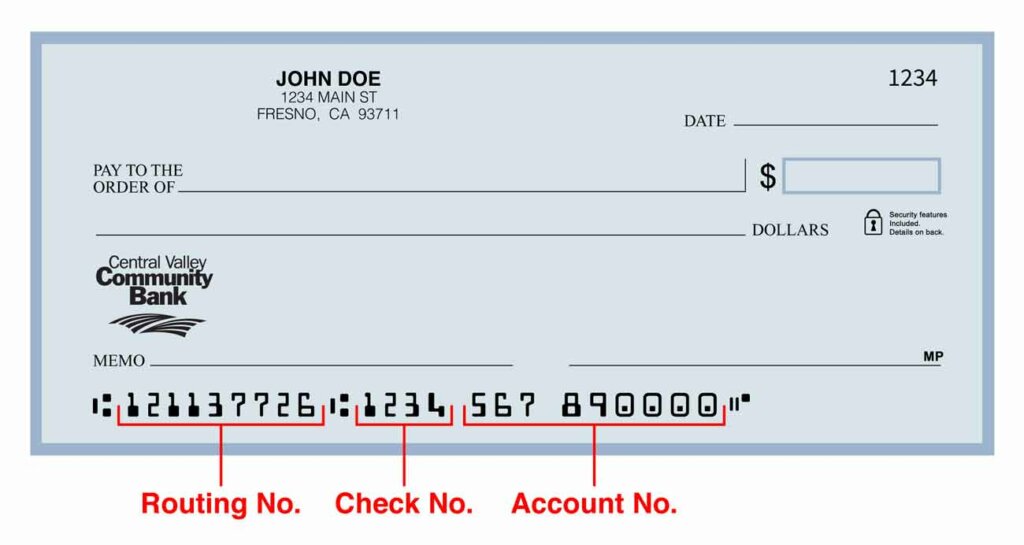

Locating the ABA number on a check is relatively straightforward. On a personal check, the routing number is usually the first group of numbers at the bottom left-hand corner. It is printed in a magnetic ink character recognition (MICR) format, which allows banks to process checks electronically.

- Look at the bottom of your check for a series of numbers.

- The first nine-digit code on the left is your ABA number.

- The account number follows the ABA number, and the check number is usually located on the far right.

ABA Number on Business Checks

Business checks may have a slightly different layout, but the ABA number is still located at the bottom of the check. It is important to double-check the position of the routing number, as some business checks may place it in a different order compared to personal checks.

ABA Number vs. Routing Number

While the terms "ABA number" and "routing number" are often used interchangeably, there are subtle differences depending on the context. The ABA routing number specifically refers to the nine-digit code assigned by the American Bankers Association. However, some banks may use different terms, such as "ACH routing number" or "wire routing number," depending on the type of transaction.

Read also:Pittsburgh Penguins Game Results Your Ultimate Guide To Every Play Player And Performance

- ABA Routing Number: Used for both paper checks and electronic transactions.

- ACH Routing Number: Specifically used for electronic transactions like direct deposits or automatic bill payments.

- Wire Routing Number: Used exclusively for domestic and international wire transfers.

It's crucial to confirm which routing number your bank requires for specific transactions to avoid errors.

Common Uses of the ABA Number

Direct Deposits

One of the most common uses of the ABA number is for setting up direct deposits. Employers use this routing number to transfer your salary directly into your bank account. Providing the correct ABA number ensures that your funds are deposited accurately and on time.

Wire Transfers

When initiating a wire transfer, you'll need to provide the ABA number to ensure the funds are sent to the correct bank. Domestic wire transfers typically use the standard ABA routing number, while international transfers may require additional information, such as a SWIFT code.

Automatic Bill Payments

Many people use automatic bill payment services to pay recurring bills like utilities, loans, or subscriptions. The ABA number is required to set up these payments, ensuring that funds are deducted from your account automatically.

A Brief History of the ABA Number

The ABA routing number was first introduced in 1910 by the American Bankers Association to improve the efficiency of check processing. At the time, the banking system was manual and prone to errors. The introduction of the routing number helped standardize the process, making it easier for banks to identify and route checks to the correct institutions.

Over the years, the ABA number has evolved to accommodate electronic transactions, such as ACH transfers and wire transfers. Today, the routing number remains a critical component of the banking system, ensuring the accuracy and security of financial transactions.

Using ABA Numbers in Digital Transactions

With the rise of digital banking, the ABA number plays an increasingly important role in online transactions. Whether you're setting up a direct deposit, initiating a wire transfer, or paying bills online, the ABA number is essential for ensuring that funds are routed correctly.

Most banks provide online platforms where you can easily find your ABA number. Simply log in to your account and navigate to the account information section. Many banks also offer mobile apps that allow you to access your routing number quickly and securely.

Security Concerns with ABA Numbers

While the ABA number is necessary for various financial transactions, it's important to keep it secure to prevent fraud. Sharing your routing number with unauthorized parties can lead to unauthorized transactions or identity theft.

To protect your ABA number:

- Only provide it to trusted individuals or organizations.

- Use secure methods of communication when sharing your routing number.

- Regularly monitor your bank account for any suspicious activity.

Common Errors and How to Avoid Them

Incorrect ABA Number

One of the most common errors when using the ABA number is providing the wrong routing number. This can result in delayed or failed transactions. To avoid this, always double-check the ABA number before initiating any financial activity.

Using the Wrong Type of Routing Number

Another common mistake is using the wrong type of routing number for a specific transaction. For example, using an ACH routing number for a wire transfer may cause the transaction to fail. Always confirm which routing number your bank requires for the transaction you're initiating.

Frequently Asked Questions About ABA Numbers

What Happens if I Provide the Wrong ABA Number?

If you provide the wrong ABA number, your transaction may be delayed or returned. In some cases, the bank may charge a fee for the failed transaction. Always verify the ABA number before initiating any financial activity.

Can I Use the Same ABA Number for All Transactions?

While many banks use the same ABA number for all transactions, some institutions may have different routing numbers for specific types of transactions. Always confirm with your bank to ensure you're using the correct routing number.

Is the ABA Number the Same as the Account Number?

No, the ABA number and account number are not the same. The ABA number identifies your bank, while the account number identifies your specific account within that bank. Both numbers are required for most financial transactions.

Conclusion and Next Steps

In conclusion, understanding how to locate and use your ABA number on a check is essential for managing your finances effectively. From setting up direct deposits to initiating wire transfers, the ABA number plays a crucial role in ensuring that your transactions are processed accurately and securely.

To ensure a smooth financial experience:

- Always double-check the ABA number before initiating any transaction.

- Confirm the type of routing number required for specific transactions.

- Keep your ABA number secure to prevent unauthorized access.

We encourage you to share this article with friends or family who may benefit from understanding the importance of the ABA number. For more insights into personal finance and banking, explore our other articles on our website. Your feedback and questions are always welcome, so feel free to leave a comment below!

Data Sources: