Opening a Fifth Third Bank account online has never been easier. With just a few clicks, you can access a wide range of banking services tailored to your financial needs. Whether you're looking for a checking account, savings account, or other banking solutions, Fifth Third Bank provides a seamless digital experience. In this article, we'll walk you through the process step-by-step, ensuring you have all the information you need to make an informed decision.

Fifth Third Bank is one of the leading financial institutions in the United States, offering a variety of banking products and services. Opening an account online not only saves time but also allows you to manage your finances more efficiently. This guide will explore the benefits of online banking, the types of accounts available, and the steps required to open an account.

By the end of this article, you'll have a clear understanding of how to open a Fifth Third Bank account online and the advantages it offers. Whether you're a new customer or looking to expand your existing banking relationship, this guide will help you navigate the process effortlessly.

Read also:How Old Was Juice Wrld When He Made Lucid Dreams

Table of Contents

- Why Open a Fifth Third Bank Account?

- Types of Accounts Available

- Benefits of Online Banking

- Step-by-Step Guide to Open a Fifth Third Bank Account Online

- Documents Required for Online Account Opening

- Fifth Third Bank Account Fees

- Security Features of Online Banking

- Customer Support for Fifth Third Bank

- Frequently Asked Questions

- Conclusion

Why Open a Fifth Third Bank Account?

Fifth Third Bank has been serving customers for over 150 years, providing reliable financial services across the United States. By opening a Fifth Third Bank account, you gain access to a wide range of benefits, including competitive interest rates, advanced mobile banking features, and personalized financial advice.

Advantages of Choosing Fifth Third Bank

- Wide network of ATMs and branches

- Advanced online banking platform

- 24/7 customer support

- Customizable account options

- Security features to protect your financial information

Opening a Fifth Third Bank account online allows you to manage your finances conveniently from anywhere, anytime. With their user-friendly platform, you can easily track your transactions, set up automatic payments, and monitor your account activity.

Types of Accounts Available

Fifth Third Bank offers a variety of account options to meet the diverse needs of its customers. Whether you're looking for a checking account, savings account, or investment account, there's a solution tailored to your financial goals.

Checking Accounts

Checking accounts are designed for everyday banking needs, allowing you to make deposits, withdrawals, and payments with ease. Fifth Third Bank offers several types of checking accounts, including:

- Standard Checking

- Premium Checking

- Student Checking

Savings Accounts

Savings accounts help you grow your money by offering competitive interest rates. Fifth Third Bank provides various savings account options, such as:

- Traditional Savings

- Money Market Savings

- High-Yield Savings

Benefits of Online Banking

Online banking offers numerous advantages, making it a convenient and efficient way to manage your finances. Here are some of the key benefits:

Read also:Dr G Medical Examiner Tv Show A Fascinating Dive Into Forensic Science

Convenience and Accessibility

With online banking, you can access your account anytime, anywhere, using your computer or mobile device. This flexibility allows you to stay on top of your finances without visiting a physical branch.

Real-Time Account Updates

Online banking provides real-time updates on your account activity, ensuring you always have the most current information at your fingertips. This feature helps you monitor your transactions and avoid unexpected fees.

Automated Services

You can set up automated services, such as bill payments and account transfers, to streamline your financial management. This saves time and ensures timely payments, reducing the risk of late fees.

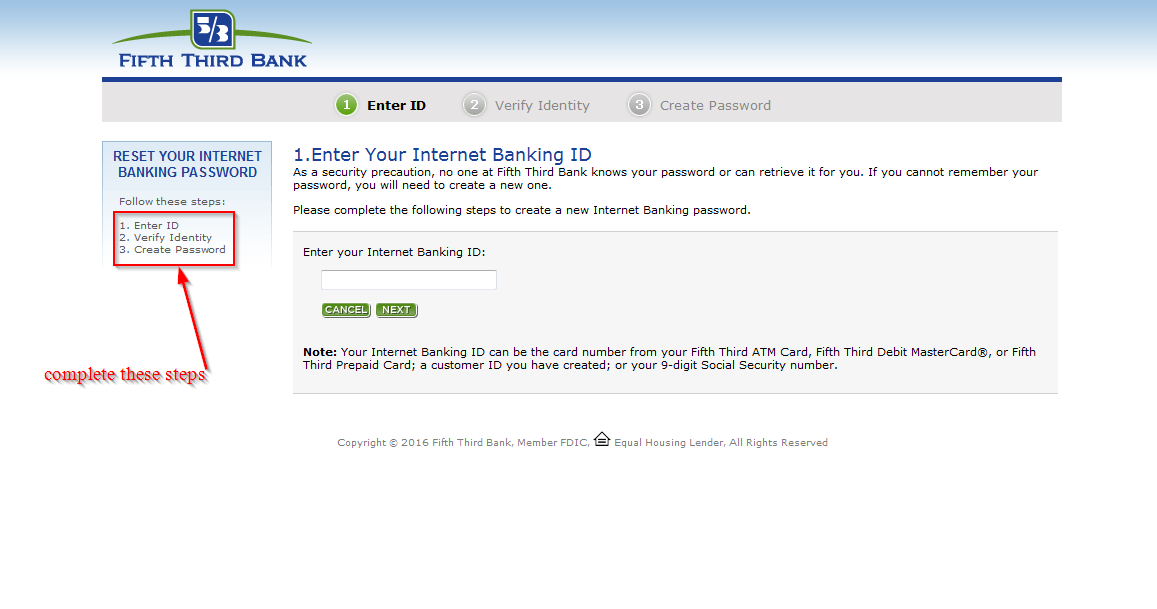

Step-by-Step Guide to Open a Fifth Third Bank Account Online

Opening a Fifth Third Bank account online is a straightforward process. Follow these steps to get started:

Step 1: Visit the Fifth Third Bank Website

Go to the official Fifth Third Bank website and navigate to the "Open an Account" section.

Step 2: Select the Account Type

Choose the type of account you wish to open, such as checking, savings, or investment.

Step 3: Provide Personal Information

Fill out the required personal details, including your name, address, Social Security number, and contact information.

Step 4: Upload Required Documents

Upload the necessary documents to verify your identity, such as a driver's license or passport.

Step 5: Review and Confirm

Review the account details and terms, then confirm your application. You'll receive an email confirmation once your account is activated.

Documents Required for Online Account Opening

To open a Fifth Third Bank account online, you'll need to provide certain documents to verify your identity. These include:

- Government-issued ID (driver's license, passport, etc.)

- Social Security card

- Proof of address (utility bill, lease agreement, etc.)

Ensure that all documents are up-to-date and legible to avoid any delays in the account opening process.

Fifth Third Bank Account Fees

Understanding the fees associated with your account is essential for effective financial planning. Fifth Third Bank offers transparent fee structures, and some common fees include:

- Monthly maintenance fees

- ATM fees

- Overdraft fees

- Wire transfer fees

Many of these fees can be waived by maintaining a minimum balance or using direct deposit. Be sure to review the fee schedule provided by Fifth Third Bank to avoid unexpected charges.

Security Features of Online Banking

Fifth Third Bank prioritizes the security of its customers' financial information. They employ advanced security measures, such as:

- Two-factor authentication

- Encryption technology

- Account alerts and notifications

These features ensure that your account remains secure and protected from unauthorized access. Always use strong passwords and enable multi-factor authentication for added security.

Customer Support for Fifth Third Bank

Fifth Third Bank provides excellent customer support to assist you with any questions or issues related to your account. You can reach their support team through:

- Phone: Available 24/7

- Email: For non-urgent inquiries

- Live Chat: On their official website

Their knowledgeable representatives are ready to help you with account setup, troubleshooting, and other banking-related matters.

Frequently Asked Questions

Q: Can I open a Fifth Third Bank account from outside the U.S.?

A: Yes, you can open a Fifth Third Bank account online from anywhere in the world, provided you meet the eligibility criteria and have the required documents.

Q: Is there a minimum deposit requirement?

A: Some account types may require a minimum deposit to open. Check the specific account details for more information.

Q: How long does it take to open an account online?

A: The account opening process typically takes a few minutes to complete, depending on the speed of your internet connection and the time it takes to upload documents.

Conclusion

Opening a Fifth Third Bank account online is a simple and efficient way to access comprehensive banking services. With a wide range of account options, advanced security features, and excellent customer support, Fifth Third Bank is an excellent choice for managing your finances.

We encourage you to take the first step and open your account today. If you have any questions or need further assistance, feel free to leave a comment below or contact Fifth Third Bank's customer support team. Don't forget to share this article with others who may benefit from it, and explore more informative content on our website.