The State of Montana Dept of Revenue plays a pivotal role in managing the financial systems of the state, ensuring compliance with tax laws, and providing essential services to both residents and businesses. Whether you're a new resident, a business owner, or someone seeking clarity on tax-related matters, understanding this department is crucial. In this article, we will delve into the workings of the Montana Dept of Revenue, its responsibilities, and how it impacts your life.

Montana is known for its breathtaking landscapes and vibrant communities, but behind the scenes, the state's revenue department works tirelessly to maintain financial stability and transparency. From overseeing tax collection to administering various licenses and permits, the State of Montana Dept of Revenue ensures that resources are allocated efficiently for the benefit of all citizens.

As we explore this topic further, you'll gain a deeper understanding of the department's structure, its key functions, and how it contributes to the economic well-being of Montana. By the end of this article, you'll be equipped with the knowledge to navigate the complexities of tax laws and revenue management within the state.

Read also:How Much Is Family Guy Worth Exploring The Value Of A Beloved Animation

Table of Contents

- Introduction to the Montana Dept of Revenue

- Historical Overview of the Montana Dept of Revenue

- Key Functions and Responsibilities

- Montana's Tax System

- Licenses and Permits

- Revenue Collections and Management

- Resources for Residents and Businesses

- Compliance and Enforcement

- Technology and Innovation in Revenue Management

- Future Prospects and Challenges

Introduction to the Montana Dept of Revenue

The State of Montana Dept of Revenue is a critical government agency responsible for overseeing the state's financial health. Established to manage taxation, licensing, and revenue collection, the department ensures that funds are collected and allocated effectively. This section will introduce you to the foundational aspects of the department and its importance in the state's economy.

Role in State Governance

The Montana Dept of Revenue serves as the backbone of state governance by ensuring that all financial transactions comply with federal and state regulations. It administers various programs, including property taxes, fuel taxes, and cigarette taxes, which contribute significantly to the state's budget. By maintaining transparency and accountability, the department builds trust with the public.

Historical Overview of the Montana Dept of Revenue

To understand the current operations of the Montana Dept of Revenue, it's essential to explore its historical roots. Established in the early 20th century, the department has evolved over the years to adapt to changing economic conditions and technological advancements.

Key Milestones

- Formation of the department in 1919

- Expansion of services in the 1950s

- Introduction of electronic filing in the 1990s

Key Functions and Responsibilities

The State of Montana Dept of Revenue performs several vital functions that impact the daily lives of residents and businesses. Below is a detailed breakdown of its responsibilities:

Primary Functions

- Tax administration

- License issuance and renewal

- Revenue collection and disbursement

Montana's Tax System

Montana's tax system is designed to be fair and equitable, with various types of taxes contributing to the state's revenue. Understanding the tax structure is essential for both individuals and businesses to ensure compliance and avoid penalties.

Types of Taxes

The Montana Dept of Revenue oversees several types of taxes, including:

Read also:Cofounder Of Facebook The Untold Story Of The Visionaries Behind The Social Media Empire

- Income tax

- Property tax

- Sales tax (selective)

Licenses and Permits

One of the critical responsibilities of the Montana Dept of Revenue is the issuance and management of licenses and permits. These documents are essential for businesses and professionals operating within the state.

Common Licenses

- Business licenses

- Professional licenses

- Vehicle registration

Revenue Collections and Management

Effective revenue collection is at the core of the Montana Dept of Revenue's operations. By implementing robust systems and processes, the department ensures that funds are collected efficiently and allocated appropriately.

Collection Methods

The department utilizes various methods to collect revenue, including:

- Electronic filing

- Direct payments

- Third-party reporting

Resources for Residents and Businesses

The State of Montana Dept of Revenue provides numerous resources to assist residents and businesses in understanding and complying with tax laws. These resources include online tools, guides, and customer support services.

Online Tools

- Tax calculators

- Forms and publications

- FAQs and tutorials

Compliance and Enforcement

Ensuring compliance with tax laws is a top priority for the Montana Dept of Revenue. The department employs various strategies to enforce regulations and address non-compliance issues.

Enforcement Strategies

- Audits and investigations

- Fines and penalties

- Education and outreach programs

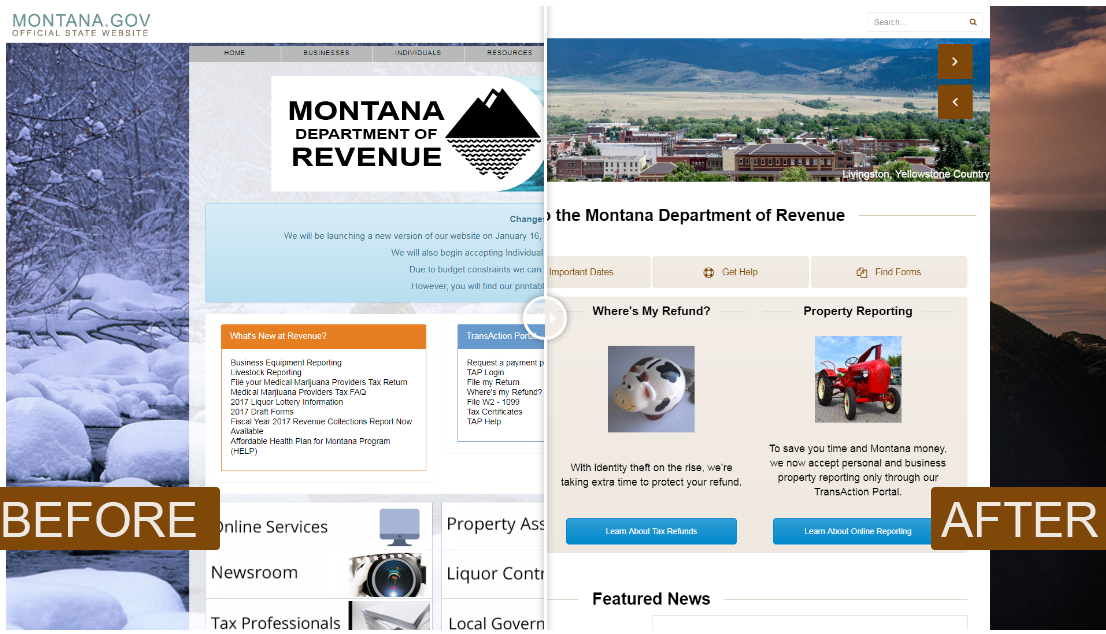

Technology and Innovation in Revenue Management

The State of Montana Dept of Revenue continues to embrace technology to enhance its operations and improve service delivery. By leveraging digital platforms and data analytics, the department aims to streamline processes and increase efficiency.

Technological Advancements

- Electronic filing systems

- Data analytics for trend analysis

- Mobile applications for convenience

Future Prospects and Challenges

As the State of Montana Dept of Revenue looks to the future, it faces both opportunities and challenges. The department must continue to adapt to changing economic conditions and technological advancements while maintaining its commitment to transparency and fairness.

Potential Challenges

- Evolving tax laws

- Technological disruptions

- Resource allocation

Conclusion

In conclusion, the State of Montana Dept of Revenue plays a vital role in managing the state's financial systems and ensuring compliance with tax laws. By understanding its functions and responsibilities, residents and businesses can better navigate the complexities of tax and revenue management. We encourage you to explore the resources provided by the department and stay informed about updates and changes that may impact your financial obligations.

We invite you to share your thoughts and experiences in the comments section below. Additionally, feel free to explore other articles on our website for more insights into financial management and related topics. Together, let's build a more informed and prosperous community.

Data Sources: Montana Dept of Revenue Official Website, State of Montana Official Website, IRS Official Website