Financial fraud is a growing concern for millions of consumers worldwide, and identifying the correct Fifth Third Bank fraud phone number is crucial for safeguarding your assets. Whether you suspect unauthorized transactions or simply want to ensure your account's security, knowing the proper channels to report fraud is essential. In this article, we will provide you with a detailed guide to Fifth Third Bank's fraud phone number, along with practical tips to protect your finances.

Fifth Third Bank, one of the largest financial institutions in the United States, offers a wide range of services, including banking, lending, and investment solutions. However, with the rise in cybercrime and identity theft, it's vital to know how to handle potential fraud cases effectively. This article will walk you through everything you need to know about reporting fraud and securing your accounts.

Whether you're a long-time customer or new to Fifth Third Bank, understanding the steps to report suspicious activities can save you from significant financial losses. Let's dive into the details and empower you with the knowledge to protect your financial well-being.

Read also:When Did Slavery End In America A Comprehensive Guide

Table of Contents

- Introduction to Fifth Third Bank Fraud Reporting

- Fifth Third Bank Fraud Phone Number

- About Fifth Third Bank

- Steps to Report Fraud

- Common Types of Fraud

- Preventive Measures Against Fraud

- Fifth Third Bank Customer Support

- Legal Protections for Customers

- Fraud Statistics and Trends

- Conclusion and Call to Action

Introduction to Fifth Third Bank Fraud Reporting

Financial institutions like Fifth Third Bank have implemented robust systems to combat fraud and protect their customers. However, staying vigilant is the responsibility of every account holder. Reporting suspicious activities promptly is crucial to minimizing potential losses.

The Fifth Third Bank fraud phone number serves as a direct line for customers to report any unauthorized transactions or suspicious activities. By contacting the right department, you can initiate an investigation and secure your accounts quickly.

In this section, we'll explore the importance of timely reporting and how Fifth Third Bank assists its customers in fraud prevention.

Fifth Third Bank Fraud Phone Number

Primary Fraud Reporting Line

For Fifth Third Bank customers who suspect fraud, the fraud phone number is your first point of contact. The primary number to report fraud is 1-800-558-4848. This dedicated line ensures that your concerns are addressed promptly by trained professionals.

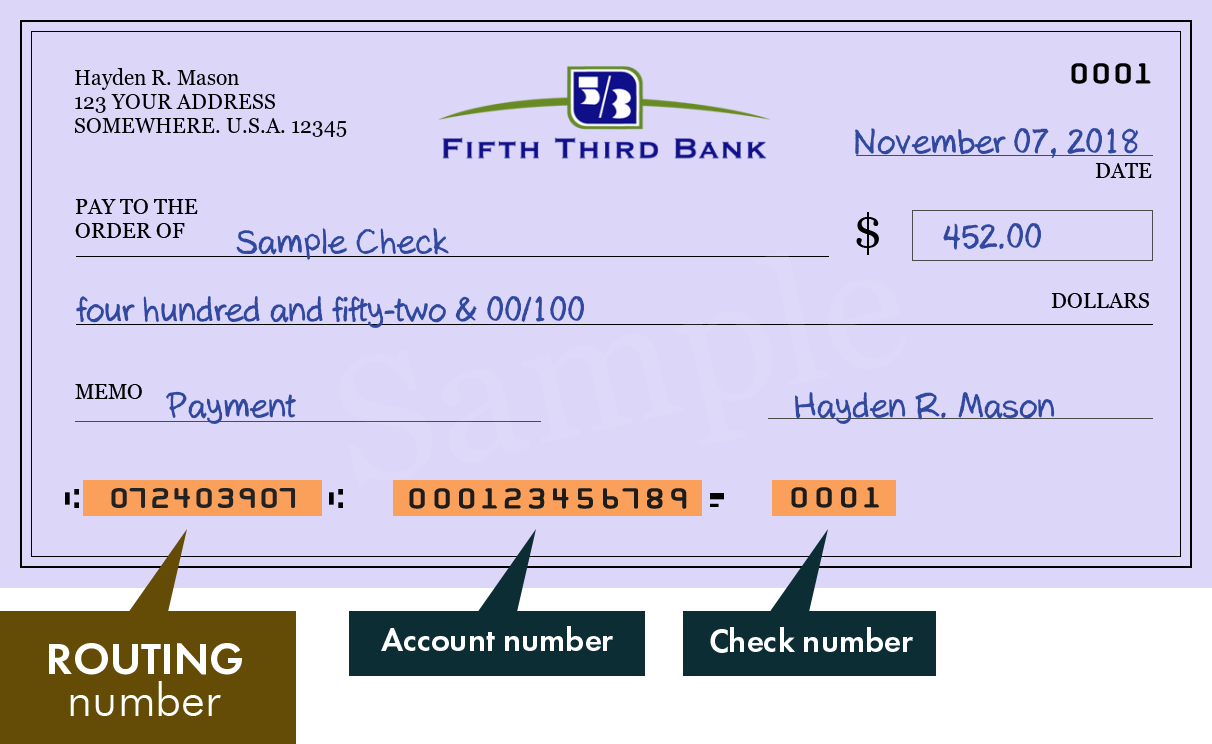

Calling this number allows you to speak directly with a fraud specialist who will guide you through the necessary steps to secure your account. It's essential to have your account information ready when making the call, as it will expedite the verification process.

Additional Contact Options

- Debit Card Fraud: 1-800-558-4848

- Credit Card Fraud: 1-800-558-4848

- Online Fraud: Contact the fraud phone number or visit the nearest branch

These numbers are available 24/7 to assist customers in need, ensuring that fraud cases are handled efficiently regardless of the time of day.

Read also:Send St Jude Valentines Cards A Heartfelt Way To Show Love And Support

About Fifth Third Bank

Fifth Third Bank, headquartered in Cincinnati, Ohio, is a leading financial services company in the United States. Established in 1858, the bank has grown to serve over 2 million customers across 10 states. It offers a wide array of services, including personal banking, commercial banking, wealth management, and investment solutions.

| Bank Name | Fifth Third Bank |

|---|---|

| Founded | 1858 |

| Headquarters | Cincinnati, Ohio |

| Assets | $200 billion+ |

| Customers | Over 2 million |

Steps to Report Fraud

Contacting the Fraud Department

Once you suspect fraudulent activity on your Fifth Third Bank account, follow these steps to report the issue:

- Call the Fifth Third Bank fraud phone number: 1-800-558-4848.

- Provide your account details for verification purposes.

- Explain the nature of the suspicious activity, including dates and amounts if known.

- Follow the instructions provided by the fraud specialist to secure your account.

Acting quickly can prevent further unauthorized transactions and help recover any stolen funds.

Documenting the Incident

After contacting the fraud department, it's important to document all communications and actions taken. Keep records of:

- Call details, including date, time, and representative name.

- Case numbers assigned by the fraud department.

- Any correspondence with Fifth Third Bank regarding the issue.

This documentation will be valuable if further action is required, such as filing a police report or disputing charges.

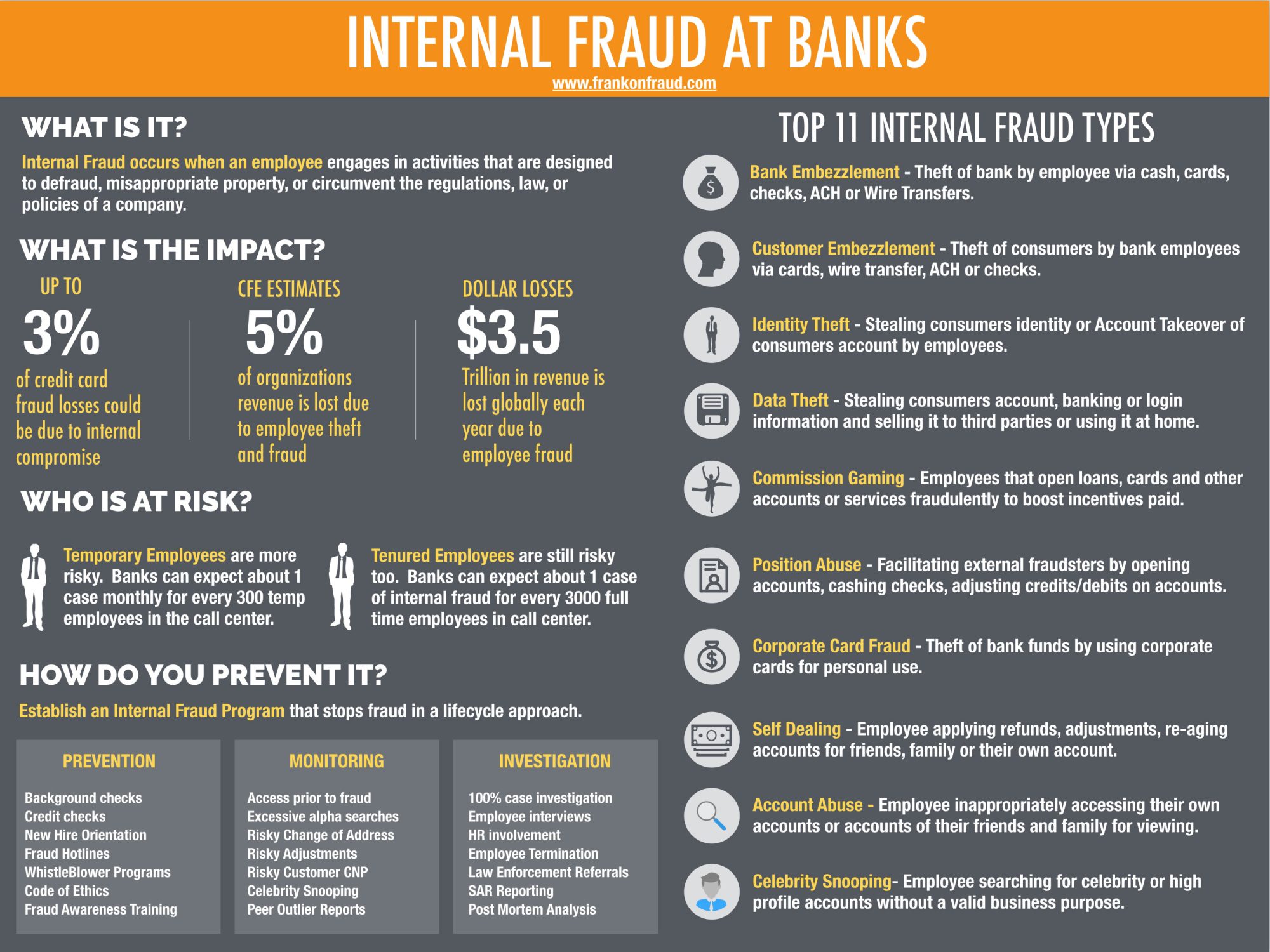

Common Types of Fraud

Fraud can take many forms, and being aware of the most common types can help you identify potential threats. Here are some prevalent fraud schemes:

- Identity Theft: Criminals obtain your personal information to access your accounts or open new ones.

- Phishing Scams: Fraudsters send fake emails or messages to trick you into revealing sensitive information.

- Card Skimming: Devices installed on ATMs or card readers capture your card information for unauthorized use.

- Online Fraud: Hackers gain access to your online accounts through phishing or malware attacks.

Stay informed about these risks and take proactive measures to protect your personal and financial data.

Preventive Measures Against Fraud

Securing Your Accounts

Prevention is the best defense against financial fraud. Here are some tips to safeguard your Fifth Third Bank accounts:

- Enable two-factor authentication for added security.

- Monitor your account activity regularly for any suspicious transactions.

- Use strong, unique passwords and update them periodically.

- Be cautious when sharing personal information online or over the phone.

By implementing these practices, you can significantly reduce the risk of falling victim to fraud.

Education and Awareness

Staying informed about the latest fraud trends and tactics is crucial. Fifth Third Bank offers educational resources to help customers recognize and prevent fraud. Take advantage of these materials to enhance your knowledge and protect your finances.

Fifth Third Bank Customer Support

Fifth Third Bank is committed to providing exceptional customer support. In addition to the fraud phone number, the bank offers multiple channels for assistance:

- Online Chat: Available through the Fifth Third Bank website.

- Email Support: Submit inquiries via the contact form on the website.

- Branch Visits: Visit any Fifth Third Bank branch for in-person assistance.

These resources ensure that customers have access to support whenever they need it.

Legal Protections for Customers

Under U.S. law, consumers are protected against fraudulent activities through various regulations. The Electronic Fund Transfer Act (EFTA) and the Fair Credit Billing Act (FCBA) provide specific safeguards for debit and credit card users. Fifth Third Bank adheres to these legal requirements, ensuring that customers receive the necessary protections.

If you experience fraud, Fifth Third Bank will work with you to resolve the issue and recover any lost funds, as mandated by law.

Fraud Statistics and Trends

According to recent studies, financial fraud is on the rise globally. The Federal Trade Commission (FTC) reported a significant increase in identity theft and credit card fraud cases in 2022. These trends highlight the importance of staying vigilant and taking proactive measures to protect your finances.

Fifth Third Bank continuously updates its security protocols to combat emerging threats and ensure the safety of its customers' accounts.

Conclusion and Call to Action

In conclusion, knowing the Fifth Third Bank fraud phone number and understanding the steps to report fraud are vital for protecting your financial well-being. By staying informed and implementing preventive measures, you can minimize the risk of falling victim to fraud.

We encourage you to share this article with friends and family to help them stay protected. If you have any questions or experiences to share, please leave a comment below. Additionally, explore other articles on our website for more valuable insights into personal finance and security.

Remember, your financial security is important, and Fifth Third Bank is here to support you every step of the way.