Protecting your business is not just a smart move—it's a necessity. General liability insurance plays a pivotal role in safeguarding businesses from unforeseen risks. The Hartford general liability quote provides tailored coverage options that cater to businesses of all sizes and industries, ensuring you're prepared for potential claims. Whether you're a startup or a well-established enterprise, understanding how general liability insurance works is crucial for long-term success.

General liability insurance is one of the most important types of coverage for businesses. It protects against third-party claims involving bodily injury, property damage, advertising injury, and more. With The Hartford general liability quote, businesses can access comprehensive coverage at competitive rates. This article will explore everything you need to know about general liability insurance and why The Hartford stands out as a trusted provider.

In this guide, we'll delve into the specifics of The Hartford general liability quote, including its benefits, coverage options, pricing factors, and how to obtain a quote. By the end, you'll have a clear understanding of how this insurance can protect your business and help you make informed decisions.

Read also:Pebble Beach Proam Amateurs A Comprehensive Guide To The Exciting World Of Golf

Understanding General Liability Insurance

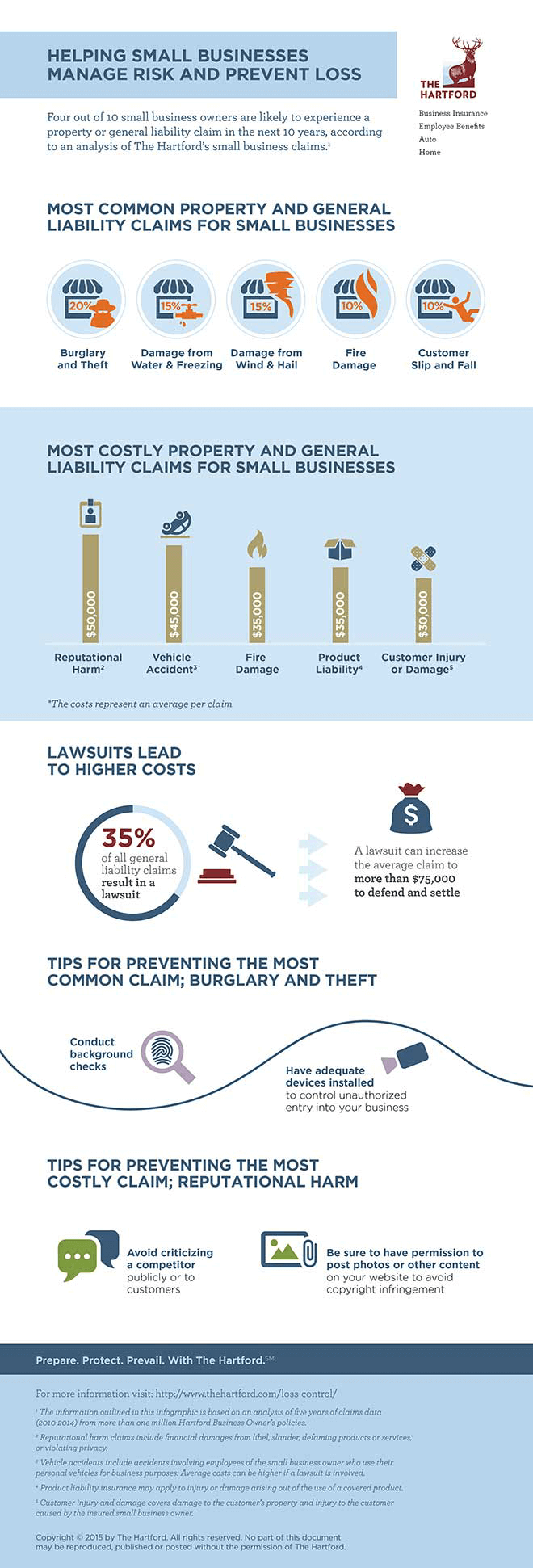

General liability insurance is a fundamental type of coverage designed to protect businesses from claims related to bodily injury, property damage, and advertising injury. It serves as a financial safety net, ensuring that your business is not left vulnerable in the event of a lawsuit or claim. Understanding what this insurance covers is essential for any business owner.

What Does General Liability Insurance Cover?

General liability insurance typically covers the following:

- Bodily injury claims resulting from accidents on your premises or due to your products/services.

- Property damage claims arising from incidents involving your business operations.

- Advertising injury claims, such as defamation or copyright infringement.

- Medical payments for minor injuries sustained by third parties.

These coverages are designed to mitigate risks and protect your business from potential financial losses. However, it's important to note that each policy may have exclusions and limitations, so reviewing your specific policy details is crucial.

Why Choose The Hartford General Liability Quote?

The Hartford is a renowned insurance provider with a long history of offering reliable and comprehensive coverage solutions. When considering a general liability quote, The Hartford stands out for several reasons:

Reputation and Experience

Established in 1810, The Hartford has over two centuries of experience in the insurance industry. Their expertise in risk management and insurance solutions makes them a trusted partner for businesses of all sizes. The Hartford's commitment to customer service and innovation ensures that policyholders receive the best possible protection.

Customizable Coverage Options

One of the key advantages of The Hartford general liability quote is the ability to customize coverage based on your business's unique needs. Whether you require additional insured endorsements, higher liability limits, or specialized coverage for specific industries, The Hartford offers flexible options to meet your requirements.

Read also:Frosting Without Powdered Sugar Recipes Delicious Alternatives For Your Baking Adventures

Factors Affecting The Hartford General Liability Quote

The cost of a general liability insurance quote from The Hartford depends on various factors. Understanding these factors can help you anticipate the pricing and make informed decisions about your coverage.

Business Size and Industry

Smaller businesses may have lower premiums compared to larger enterprises due to reduced risk exposure. Additionally, certain industries, such as construction or healthcare, may incur higher premiums due to the inherent risks associated with those fields.

Location and Claims History

Your business's location and past claims history also play a significant role in determining your premium. Businesses located in areas prone to natural disasters or with a history of frequent claims may face higher costs. Conversely, businesses with a clean claims record may qualify for discounts.

How to Obtain a Hartford General Liability Quote

Getting a Hartford general liability quote is a straightforward process. Follow these steps to ensure you receive an accurate and comprehensive quote:

Step 1: Gather Necessary Information

Before requesting a quote, gather essential information about your business, including:

- Business type and industry

- Number of employees

- Annual revenue

- Location(s) of operation

Having this information readily available will streamline the quoting process and ensure accuracy.

Step 2: Contact The Hartford

You can obtain a quote by visiting The Hartford's website or contacting a licensed agent. Both options provide access to detailed information and personalized assistance to help you find the right coverage for your business.

Benefits of The Hartford General Liability Insurance

Investing in The Hartford general liability insurance offers numerous benefits that extend beyond basic coverage. Here are some key advantages:

Comprehensive Coverage

The Hartford's general liability policies provide robust protection against a wide range of risks, ensuring your business is safeguarded from potential lawsuits and claims.

Exceptional Customer Service

With dedicated account managers and 24/7 support, The Hartford ensures that policyholders receive prompt assistance whenever needed. Their commitment to customer satisfaction sets them apart from competitors.

Common Misconceptions About General Liability Insurance

There are several misconceptions surrounding general liability insurance that can lead to inadequate coverage or unnecessary expenses. Here are a few common myths debunked:

Myth 1: General Liability Insurance Covers Everything

While general liability insurance covers a broad range of risks, it does not include coverage for workers' compensation, professional liability, or cyber liability. Businesses should assess their unique needs and consider additional coverage options if necessary.

Myth 2: Only Large Businesses Need General Liability Insurance

Regardless of size, all businesses face potential risks and should have general liability insurance. Even small businesses can encounter claims that could result in significant financial losses without proper coverage.

Real-Life Examples of General Liability Claims

Understanding real-life examples of general liability claims can help illustrate the importance of having adequate coverage. Here are a few scenarios:

Example 1: Slip and Fall Incident

A customer slips and falls in a retail store, sustaining injuries. The customer files a claim for medical expenses and lost wages. General liability insurance would cover the costs associated with the claim, protecting the business from financial liability.

Example 2: Advertising Injury

A business is accused of using a competitor's trademarked slogan in their advertising campaign. The competitor files a lawsuit for trademark infringement. General liability insurance would cover legal fees and settlement costs if the business is found liable.

Tips for Maximizing Your General Liability Coverage

To get the most out of your general liability insurance, consider the following tips:

Regular Policy Reviews

Review your policy annually to ensure it still meets your business's needs. As your business grows or changes, your coverage requirements may also evolve.

Implement Risk Management Strategies

Adopting proactive risk management practices can reduce the likelihood of claims and lower your insurance premiums. This includes training employees, maintaining safe work environments, and implementing quality control measures.

Conclusion

In conclusion, The Hartford general liability quote provides businesses with comprehensive coverage options tailored to their specific needs. Understanding the importance of general liability insurance and selecting the right provider is vital for protecting your business from potential risks. By choosing The Hartford, you gain access to expert advice, customizable coverage, and exceptional customer service.

We encourage you to take action by obtaining a quote and exploring the benefits of The Hartford general liability insurance. Share your thoughts and experiences in the comments below, and don't forget to explore other informative articles on our website for more valuable insights.

Table of Contents

- Understanding General Liability Insurance

- What Does General Liability Insurance Cover?

- Why Choose The Hartford General Liability Quote?

- Reputation and Experience

- Customizable Coverage Options

- Factors Affecting The Hartford General Liability Quote

- Business Size and Industry

- Location and Claims History

- How to Obtain a Hartford General Liability Quote

- Gather Necessary Information

- Contact The Hartford

- Benefits of The Hartford General Liability Insurance

- Comprehensive Coverage

- Exceptional Customer Service

- Common Misconceptions About General Liability Insurance

- Myth 1: General Liability Insurance Covers Everything

- Myth 2: Only Large Businesses Need General Liability Insurance

- Real-Life Examples of General Liability Claims

- Example 1: Slip and Fall Incident

- Example 2: Advertising Injury

- Tips for Maximizing Your General Liability Coverage

- Regular Policy Reviews

- Implement Risk Management Strategies