In today's digital banking world, understanding ABAs and routing numbers is crucial for managing financial transactions effectively. Whether you're setting up direct deposits, paying bills online, or transferring money between accounts, these numbers play a significant role in ensuring your transactions are processed accurately and efficiently.

As financial systems continue to evolve, knowing the ins and outs of these numbers can save you from potential errors and delays. This article will delve into the details of ABAs and routing numbers, explaining what they are, how they function, and why they are essential in the banking industry.

Whether you're a seasoned finance professional or someone new to the world of banking, this guide will provide you with the knowledge you need to navigate the complexities of banking transactions seamlessly.

Read also:What Does Camp David Look Like A Comprehensive Guide To The Presidents Retreat

What is an ABA Routing Number?

An ABA routing number, also known as a routing transit number (RTN), is a nine-digit code used by banks and financial institutions in the United States to identify the specific institution involved in a financial transaction. This number ensures that funds are directed to the correct bank or credit union, facilitating smooth and secure transfers.

History of the ABA Routing Number

The ABA routing number was first introduced in 1910 by the American Bankers Association (ABA) to standardize the identification of financial institutions. Over the years, the system has evolved to accommodate the growing complexity of banking operations.

- It was originally designed to streamline check processing.

- Today, it is used for electronic funds transfers and other financial transactions.

How Does an ABA Routing Number Work?

The ABA routing number works as a unique identifier for banks and financial institutions. Each digit in the nine-digit code serves a specific purpose, ensuring accurate processing of transactions. The first four digits represent the Federal Reserve routing symbol, while the next four digits identify the financial institution. The final digit acts as a checksum to verify the validity of the routing number.

Breaking Down the Routing Number

To better understand the structure of an ABA routing number, let's break it down:

- First four digits: Represent the Federal Reserve bank where the institution holds an account.

- Next four digits: Identify the specific financial institution.

- Last digit: Acts as a checksum to ensure the routing number is valid.

Types of ABA Routing Numbers

There are two primary types of ABA routing numbers: ACH and wire transfer routing numbers. While both serve the purpose of identifying financial institutions, they differ in their application and functionality.

ACH Routing Numbers

Automated Clearing House (ACH) routing numbers are used for electronic transactions such as direct deposits, bill payments, and automated transfers. These numbers are typically the same as the routing number found on your checks.

Read also:Fox 13 Breaking News Memphis Your Ultimate Source For Local Updates

Wire Transfer Routing Numbers

Wire transfer routing numbers are used specifically for international or domestic wire transfers. These numbers may differ from the ACH routing number, so it's essential to confirm the correct number with your bank before initiating a wire transfer.

Where to Find Your ABA Routing Number

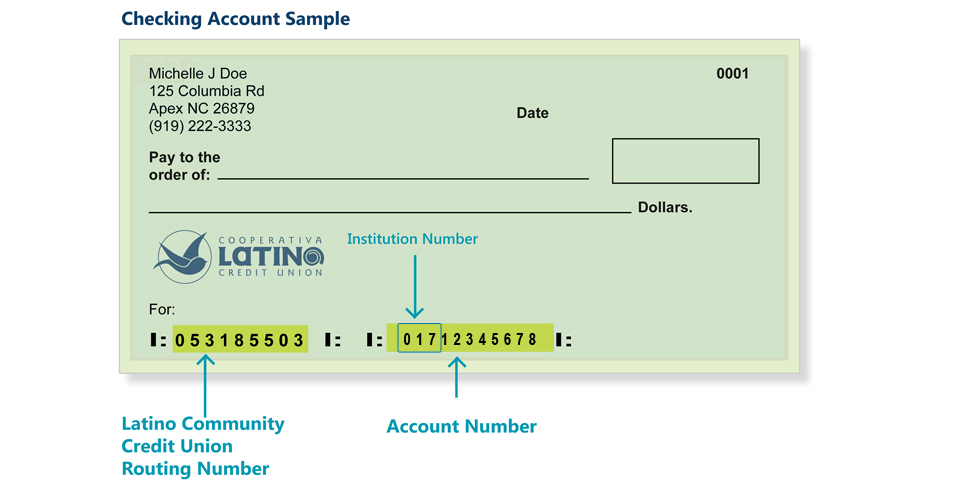

Locating your ABA routing number is straightforward. You can find it in several places:

- On your checks: The routing number is usually printed at the bottom of your checks, to the left of your account number.

- Online banking: Most banks provide your routing number in the account information section of their online banking platform.

- Bank website: Many banks list their routing numbers on their official websites for customer convenience.

Importance of ABA Routing Numbers in Banking

ABA routing numbers are vital for maintaining the integrity and efficiency of financial transactions. They ensure that funds are directed to the correct institution, preventing errors and delays in processing. Additionally, they play a crucial role in safeguarding the security of financial transactions by verifying the authenticity of the involved parties.

Preventing Errors in Transactions

By using the correct ABA routing number, you can avoid common errors such as:

- Incorrect account identification.

- Delays in processing transactions.

- Failed transfers due to mismatched information.

Common Misconceptions About ABA Routing Numbers

Despite their widespread use, there are several misconceptions about ABA routing numbers. Some people believe that all banks use the same routing number, while others think that routing numbers are interchangeable between ACH and wire transfers. Understanding these myths can help you avoid potential pitfalls when managing your finances.

Myth vs. Reality

- Myth: All banks share the same routing number.

- Reality: Each bank or credit union has its unique routing number.

- Myth: ACH and wire transfer routing numbers are the same.

- Reality: These numbers can differ depending on the bank and the type of transaction.

How to Verify an ABA Routing Number

Verifying an ABA routing number is essential to ensure the accuracy of your transactions. You can verify the routing number through several methods:

- Bank verification: Contact your bank directly to confirm the routing number.

- Online tools: Use reputable online tools to validate the routing number.

- Federal Reserve database: Access the Federal Reserve's database for official verification.

Security Measures for ABA Routing Numbers

Protecting your ABA routing number is crucial to safeguarding your financial information. Avoid sharing your routing number unnecessarily and ensure that any platform you use for transactions is secure and reputable.

Tips for Protecting Your Routing Number

- Never share your routing number via unsecured channels.

- Regularly monitor your account for unauthorized transactions.

- Use trusted platforms for financial transactions.

Future of ABA Routing Numbers

As technology continues to advance, the role of ABA routing numbers in banking is likely to evolve. Innovations such as blockchain and digital currencies may influence how financial institutions process transactions, potentially altering the need for traditional routing numbers.

Conclusion

In conclusion, understanding ABAs and routing numbers is essential for anyone involved in banking transactions. These nine-digit codes play a vital role in ensuring the accuracy and security of financial transfers. By familiarizing yourself with the structure, types, and importance of routing numbers, you can navigate the banking system with confidence.

We encourage you to take action by verifying your routing number and ensuring its proper use in your transactions. Share this article with friends and family to help them gain a better understanding of this crucial aspect of banking. For more insights into finance and banking, explore our other articles on the website.

Table of Contents

- What is an ABA Routing Number?

- How Does an ABA Routing Number Work?

- Types of ABA Routing Numbers

- Where to Find Your ABA Routing Number

- Importance of ABA Routing Numbers in Banking

- Common Misconceptions About ABA Routing Numbers

- How to Verify an ABA Routing Number

- Security Measures for ABA Routing Numbers

- Future of ABA Routing Numbers

- Conclusion