ABA numbers play a crucial role in the banking industry, ensuring seamless transactions between financial institutions. Whether you're sending money domestically or setting up direct deposits, understanding ABA routing numbers is essential for smooth banking operations. This article will delve into the intricacies of ABA numbers, explaining their significance and functionality in today's financial ecosystem.

In today's digital age, banking transactions have become more convenient and efficient. However, behind the scenes, a complex network of systems ensures that funds are transferred accurately and securely. One of the key components of this system is the ABA number, which serves as a unique identifier for financial institutions.

As we explore the world of ABA numbers, we will uncover their origins, structure, and practical applications. By the end of this article, you will have a comprehensive understanding of how ABA numbers work and why they are indispensable in modern banking.

Read also:The Ultimate Guide To The Cast Of The Family Man

Table of Contents

- Overview of ABA Numbers

- History of ABA Numbers

- Structure of an ABA Number

- Uses of ABA Numbers

- ABA Number vs. SWIFT Code

- How to Verify an ABA Number

- Benefits of ABA Numbers

- Challenges and Limitations

- Security Concerns with ABA Numbers

- The Future of ABA Numbers

Overview of ABA Numbers

ABA numbers, also known as routing transit numbers (RTNs), are nine-digit codes assigned to financial institutions in the United States. These numbers serve as identifiers that help route transactions between banks and credit unions. By using ABA numbers, financial institutions can ensure that funds are directed to the correct account holder efficiently.

In this section, we will explore the fundamental aspects of ABA numbers:

- Definition and purpose of ABA numbers

- How ABA numbers contribute to the banking system

- Why ABA numbers are critical for domestic transactions

Understanding the Importance of ABA Numbers

ABA numbers are not just arbitrary codes; they represent a standardized system that facilitates financial transactions. Without them, the process of transferring funds between banks would be significantly more complicated and prone to errors. By providing a unique identifier for each financial institution, ABA numbers streamline the movement of money across the country.

History of ABA Numbers

The concept of ABA numbers dates back to 1910 when the American Bankers Association (ABA) introduced them to standardize banking processes. Initially designed to simplify check processing, ABA numbers have evolved to support electronic transactions, direct deposits, and wire transfers. Today, they remain a cornerstone of the U.S. banking infrastructure.

Evolution of ABA Numbers

Over the years, ABA numbers have adapted to meet the demands of a rapidly changing financial landscape. Here are some key milestones in their development:

- 1910: Introduction of ABA numbers for check processing

- 1960s: Adoption of magnetic ink character recognition (MICR) for automated processing

- 1980s: Expansion to include electronic transactions

Structure of an ABA Number

An ABA number consists of nine digits, each serving a specific purpose. The structure of an ABA number can be broken down as follows:

Read also:Hyatt Place Round Rock Tx Your Ultimate Guide To Comfort And Convenience

- First four digits: Identifies the Federal Reserve Bank district and branch

- Fifth and sixth digits: Indicates the Federal Reserve check processing center

- Seventh digit: Represents the Federal Reserve Bank district

- Last four digits: Identifies the specific financial institution

How to Read an ABA Number

Understanding the structure of an ABA number is crucial for interpreting its components. By breaking down the digits, you can determine the geographical location of the bank and its unique identifier within the financial system.

Uses of ABA Numbers

ABA numbers are versatile tools that serve a variety of purposes in the banking industry. Here are some common applications:

- Direct deposits: Ensures payroll and government benefits are transferred to the correct account

- Bill payments: Facilitates automated payments for utilities, loans, and other recurring expenses

- Wire transfers: Enables secure and efficient domestic money transfers

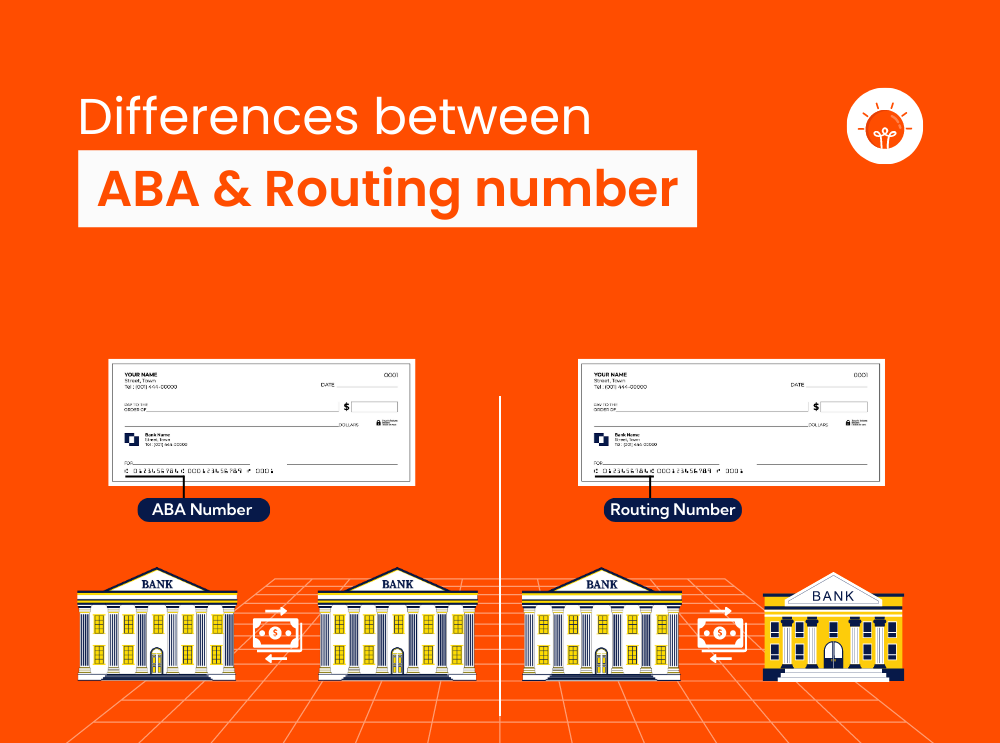

Domestic vs. International Transactions

While ABA numbers are primarily used for domestic transactions, international transfers typically require SWIFT codes. Understanding the distinction between these two systems is essential for navigating the global financial network.

ABA Number vs. SWIFT Code

Although ABA numbers and SWIFT codes serve similar purposes, they differ in scope and application. ABA numbers are exclusive to the United States, while SWIFT codes are used for international transactions. Here's a breakdown of their key differences:

- ABA numbers: Nine-digit codes for domestic transactions

- SWIFT codes: Eight-to-eleven-character alphanumeric codes for international transactions

When to Use ABA Numbers vs. SWIFT Codes

Selecting the appropriate code depends on the nature of the transaction. For domestic transfers within the U.S., an ABA number is sufficient. However, for cross-border transactions, a SWIFT code is required to ensure accurate routing.

How to Verify an ABA Number

Verifying an ABA number is essential to prevent errors and ensure secure transactions. Here are some methods for validating ABA numbers:

- Check your bank's official website or account statements

- Use online ABA number lookup tools provided by financial institutions

- Contact your bank's customer service for confirmation

Common Mistakes to Avoid

Incorrect ABA numbers can lead to failed transactions and financial losses. To avoid these issues, double-check the digits and ensure they correspond to the correct financial institution.

Benefits of ABA Numbers

ABA numbers offer numerous advantages for both individuals and financial institutions. Some of the key benefits include:

- Enhanced transaction accuracy

- Improved efficiency in processing payments

- Reduced risk of fraud and errors

Streamlining Financial Operations

By providing a standardized system for routing transactions, ABA numbers contribute to a more efficient and reliable banking experience. This benefits both consumers and financial institutions by minimizing delays and errors.

Challenges and Limitations

Despite their many advantages, ABA numbers are not without challenges. Some common limitations include:

- Compatibility issues with international systems

- Potential for human error during input

- Security concerns related to unauthorized access

Addressing Challenges

To mitigate these challenges, financial institutions implement robust verification systems and security measures. Additionally, educating customers about the importance of accurate ABA numbers can help reduce errors.

Security Concerns with ABA Numbers

As with any financial identifier, ABA numbers are vulnerable to misuse and unauthorized access. To protect sensitive information, financial institutions employ encryption and authentication protocols. However, individuals must also take steps to safeguard their ABA numbers.

Best Practices for Security

Here are some tips for keeping your ABA number secure:

- Do not share your ABA number with untrusted parties

- Regularly monitor your account for suspicious activity

- Enable two-factor authentication for added security

The Future of ABA Numbers

As technology continues to evolve, the role of ABA numbers in the financial system may change. Advances in digital banking and blockchain technology could introduce new methods for routing transactions. However, ABA numbers are likely to remain a vital component of the U.S. banking infrastructure for the foreseeable future.

Adapting to Technological Advancements

Financial institutions must stay ahead of technological trends to ensure the continued relevance and effectiveness of ABA numbers. By embracing innovation and collaboration, the banking industry can maintain the integrity and reliability of its transaction systems.

Conclusion

In conclusion, ABA numbers are indispensable tools in the modern banking system. By providing a standardized method for routing transactions, they ensure accurate and efficient financial operations. Understanding the structure, uses, and security implications of ABA numbers is essential for navigating today's complex financial landscape.

We encourage you to share your thoughts and experiences with ABA numbers in the comments section below. Additionally, feel free to explore other articles on our website for more insights into the world of finance and banking.

References: