Are you searching for the Mohela student loan number to manage your education loans? Whether it's for repayment, consolidation, or addressing concerns, having the right contact information is crucial. Mohela, one of the leading servicers of federal student loans, provides a range of services to help borrowers navigate their financial obligations effectively.

Managing student loans can be a challenging process, especially when you're trying to stay on top of payments and understand your options. With millions of students and graduates relying on federal loans, having access to reliable customer support can make all the difference in ensuring your financial stability.

In this comprehensive guide, we will walk you through everything you need to know about the Mohela student loan number, including how to contact them, what services they offer, and tips for managing your loans successfully. Let’s dive in!

Read also:Holiday Inn Montego Bay All Inclusive Your Ultimate Paradise Getaway

Table of Contents

- Biography of Mohela

- Mohela Student Loan Number and Contact Information

- Understanding Your Loan Options

- Repayment Plans and Strategies

- Loan Consolidation Services

- Student Loan Forgiveness Programs

- Troubleshooting Common Issues

- Mohela Customer Support Tips

- Student Loan Statistics

- Conclusion and Next Steps

Biography of Mohela

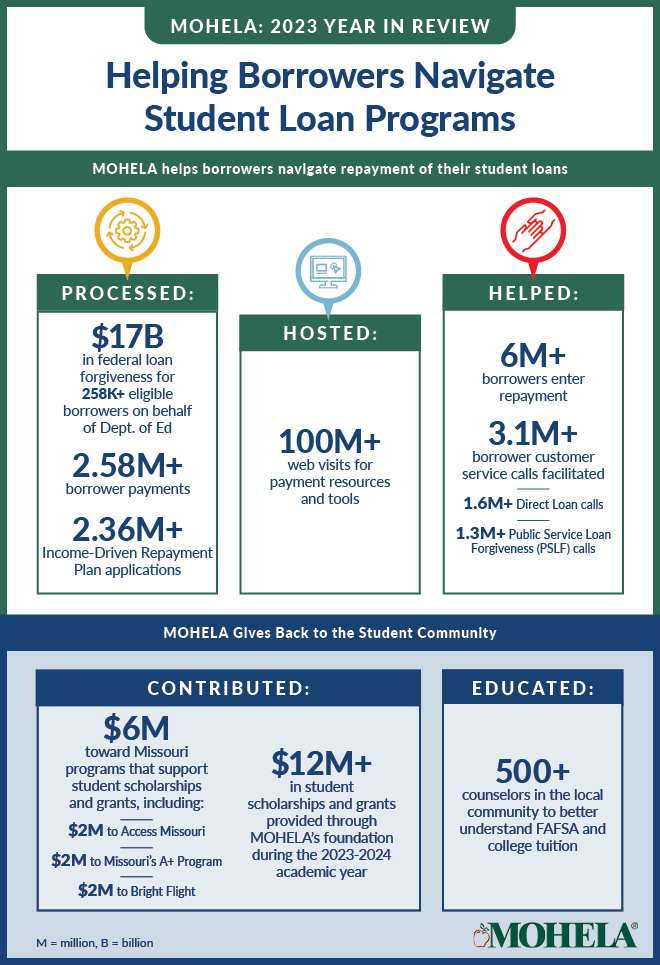

Mohela, short for Missouri Higher Education Loan Authority, is a prominent loan servicer responsible for managing federal student loans. Established in 1969, Mohela has grown to become one of the largest servicers in the United States, serving millions of borrowers annually.

Mohela Overview

As a trusted provider of student loan services, Mohela offers a wide range of solutions tailored to the needs of students and graduates. From repayment plans to loan consolidation, their mission is to help borrowers manage their loans effectively and achieve financial stability.

Mohela Data and Biodata

| Attribute | Details |

|---|---|

| Established | 1969 |

| Headquarters | St. Louis, Missouri |

| Services | Federal student loan servicing, consolidation, and repayment assistance |

| Website | my.mohela.com |

Mohela Student Loan Number and Contact Information

For borrowers seeking assistance with their Mohela loans, having the correct contact information is essential. Below are the primary ways to get in touch with Mohela:

- Customer Service Phone Number: 1-800-888-6643

- Email Support: Available through the Mohela website

- Live Chat: Accessible via the official Mohela portal

When to Call the Mohela Student Loan Number

Calling the Mohela student loan number is recommended in the following scenarios:

- Discussing repayment options

- Addressing billing errors

- Requesting loan consolidation

- Clarifying loan forgiveness programs

Understanding Your Loan Options

When it comes to student loans, understanding the different types and options available is critical. Mohela manages both federal and private loans, each with its own set of terms and conditions.

Types of Loans Serviced by Mohela

- Federal Direct Loans: Includes subsidized and unsubsidized loans

- Parent PLUS Loans: Loans for parents of dependent students

- Grad PLUS Loans: Loans for graduate and professional students

Key Features of Mohela Loans

Mohela loans come with flexible repayment terms and borrower protections, such as deferment and forbearance options. These features make it easier for borrowers to manage their financial responsibilities during challenging times.

Read also:How To Contact Ebay Support Via Email A Comprehensive Guide

Repayment Plans and Strategies

Selecting the right repayment plan is crucial for ensuring affordability and avoiding default. Mohela offers several repayment options tailored to the financial situation of each borrower.

Income-Driven Repayment Plans

Income-driven repayment plans adjust your monthly payments based on your income and family size. Some popular plans include:

- Income-Based Repayment (IBR)

- Pay As You Earn (PAYE)

- Revised Pay As You Earn (REPAYE)

Tips for Choosing a Repayment Plan

Consider the following factors when selecting a repayment plan:

- Your current income level

- Your anticipated future earnings

- The total amount of your student loans

Loan Consolidation Services

Loan consolidation is an excellent option for borrowers looking to simplify their monthly payments and potentially lower their interest rates. Mohela offers consolidation services that combine multiple loans into a single payment.

Benefits of Loan Consolidation

- Lower monthly payments

- Simplified billing process

- Potential interest rate reduction

Eligibility Criteria for Consolidation

To qualify for loan consolidation, borrowers must meet specific criteria, such as having at least one federal loan in repayment status. It’s essential to review the terms carefully before proceeding with consolidation.

Student Loan Forgiveness Programs

Loan forgiveness programs provide relief to borrowers who meet certain eligibility requirements. Mohela manages several forgiveness programs, including:

Public Service Loan Forgiveness (PSLF)

PSLF offers forgiveness to borrowers working in qualifying public service jobs after making 120 qualifying payments.

Teacher Loan Forgiveness

This program forgives up to $17,500 for teachers working in low-income schools or educational service agencies.

Income-Driven Repayment Forgiveness

After 20-25 years of income-driven repayment, any remaining balance may be forgiven, depending on the plan.

Troubleshooting Common Issues

Even with the best intentions, borrowers may encounter issues with their loans. Below are some common problems and solutions:

Handling Billing Errors

If you notice discrepancies in your billing statements, contact Mohela immediately using the Mohela student loan number or through their online portal. Providing documentation can help resolve issues quickly.

Dealing with Loan Default

Defaulting on a student loan can have severe consequences, including wage garnishment and damage to your credit score. If you’re struggling to make payments, explore options such as deferment, forbearance, or income-driven repayment plans.

Mohela Customer Support Tips

Maximizing your experience with Mohela customer support requires preparation and persistence. Here are some tips to help you get the most out of your interactions:

Preparing for a Call

- Gather all necessary documents, including loan statements and personal identification

- Prepare a list of questions or concerns you want to address

- Be patient and polite during the call

Using Online Resources

Mohela’s online portal provides a wealth of information and tools, such as payment tracking, account management, and loan calculators. Utilize these resources to stay informed and proactive about your loans.

Student Loan Statistics

Understanding the broader context of student loans can help borrowers make informed decisions. Below are some key statistics:

- Total U.S. student loan debt: Over $1.7 trillion

- Average student loan balance: Approximately $37,000

- Default rate: Around 10% of borrowers

Impact of Student Loans on Borrowers

Student loans can significantly impact borrowers' financial well-being, affecting everything from credit scores to homeownership opportunities. Managing loans effectively is essential for long-term financial health.

Conclusion and Next Steps

In conclusion, the Mohela student loan number serves as a vital resource for borrowers seeking assistance with their federal student loans. Whether you’re exploring repayment options, considering consolidation, or pursuing loan forgiveness, Mohela offers the tools and support needed to manage your loans successfully.

Take Action: If you haven’t already, contact Mohela using their student loan number or explore their online resources to gain a better understanding of your options. Share this article with others who may benefit from the information and consider exploring additional resources on our website for more insights into student loan management.

![Home Page [mohela.studentaid.gov]](https://mohela.studentaid.gov/images/Graphics/Loan-Forgiveness-Icon.png)