In today's digital age, accessing your bank account online has become an essential part of managing finances. The phrase "5 3rd bank log in" may seem confusing at first glance, but it refers to the process of securely logging into your online banking platform. Whether you're accessing your account from your smartphone, tablet, or computer, understanding the steps involved in this process is crucial for maintaining financial security.

Online banking provides convenience, allowing users to check balances, transfer funds, and pay bills without visiting a physical branch. However, with the rise of cyber threats, it's important to understand how to log in safely and protect your personal information. This article will guide you through the steps, tips, and best practices for logging into your third-party or primary bank account.

Whether you're a beginner or an experienced online banking user, this guide will help you navigate the "5 3rd bank log in" process effectively. We'll also cover important security measures to ensure your financial data remains protected at all times.

Read also:Understanding The Climate In Elizabeth A Comprehensive Guide

Table of Contents

- Understanding 5 3rd Bank Log In

- Steps to Log In to Your 3rd Bank Account

- Enhancing Security for Your Online Banking

- Common Issues and Troubleshooting

- Mobile Banking: The Future of Online Banking

- Benefits of Using 3rd Bank Online Services

- Risks Associated with Online Banking

- Best Practices for Safe Banking

- Frequently Asked Questions

- Conclusion

Understanding 5 3rd Bank Log In

When we talk about "5 3rd bank log in," we're referring to the process of accessing your account through a third-party banking platform or your primary bank's official website. The number "5" might represent steps, security layers, or even specific features within the log-in process. Understanding these components is vital for a smooth experience.

What is 3rd Bank Log In?

A third-party banking platform allows users to manage multiple accounts from different banks in one place. These platforms often provide additional features such as budget tracking, expense analysis, and automated bill payments. However, logging into these platforms requires a secure connection and proper authentication.

Why is Security Important?

Security is paramount when dealing with sensitive financial information. Banks employ advanced encryption technologies and multi-factor authentication (MFA) to protect user data. By understanding the "5 3rd bank log in" process, you can ensure that your account remains safe from unauthorized access.

Steps to Log In to Your 3rd Bank Account

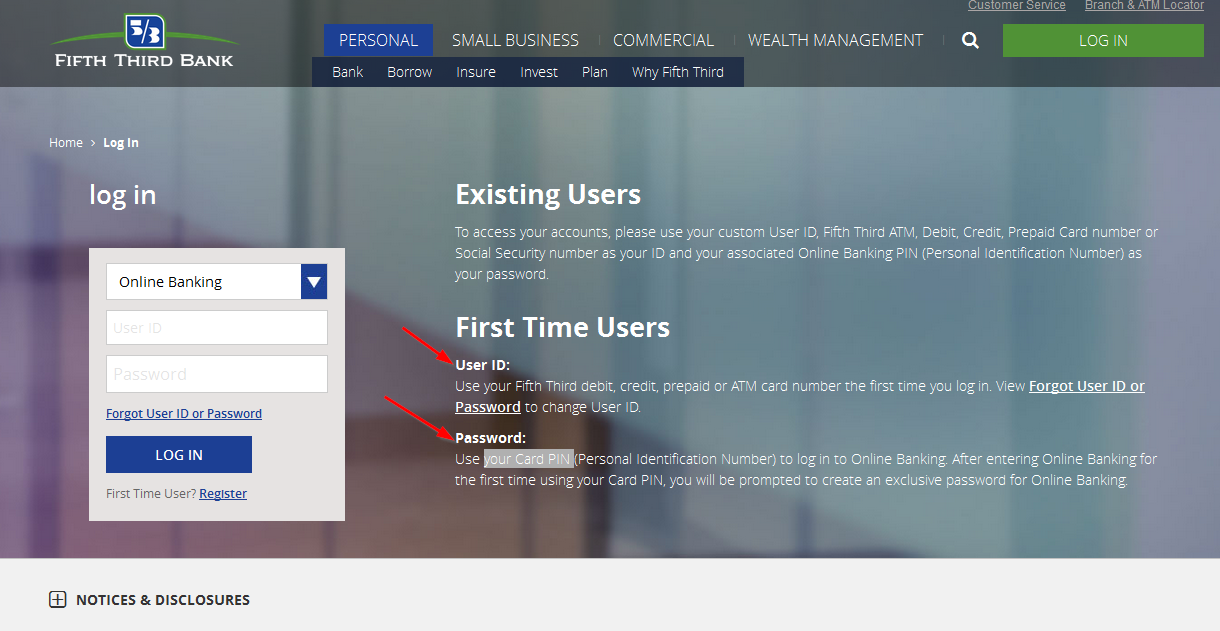

Logging into your bank account is a straightforward process, but it requires attention to detail. Below are the five essential steps to follow:

- Access the Bank's Website or App: Open your bank's official website or download their mobile app from trusted sources like Google Play Store or Apple App Store.

- Enter Your Credentials: Input your username or email address and password. Avoid using public Wi-Fi networks for this step to prevent data interception.

- Verify Your Identity: Complete any additional verification steps, such as answering security questions or entering a one-time password (OTP) sent to your phone.

- Review Security Settings: Check if two-factor authentication (2FA) is enabled. If not, enable it immediately for added protection.

- Log Out After Use: Always log out of your account after completing your transactions, especially if you're using a shared device.

Tips for a Secure Log In

Here are some additional tips to enhance your log-in experience:

- Create strong, unique passwords for each account.

- Regularly update your security questions and contact information.

- Monitor your account activity for any suspicious transactions.

Enhancing Security for Your Online Banking

With cyber threats becoming more sophisticated, it's essential to take proactive measures to protect your online banking account. Below are some strategies to enhance security:

Read also:Hyatt Place Round Rock Tx Your Ultimate Guide To Comfort And Convenience

Enable Multi-Factor Authentication

MFA adds an extra layer of protection by requiring users to provide two or more verification factors to gain access. These factors can include something you know (password), something you have (mobile device), or something you are (fingerprint).

Use Secure Connections

Avoid logging into your bank account on unsecured public Wi-Fi networks. If you must use public Wi-Fi, consider using a virtual private network (VPN) to encrypt your connection.

Regularly Update Software

Keep your devices and banking apps up to date with the latest security patches and updates. This ensures that any vulnerabilities are addressed promptly.

Common Issues and Troubleshooting

Despite the convenience of online banking, users may encounter issues during the log-in process. Below are some common problems and solutions:

Forgotten Password

If you forget your password, most banks provide a "Forgot Password" option. Follow the instructions to reset your password via email or text message.

Account Locked

If your account is locked due to multiple failed login attempts, contact your bank's customer service immediately. They can assist you in unlocking your account and resetting your credentials.

Technical Difficulties

In case of technical issues, check the bank's website or social media pages for any announcements regarding service outages. If the problem persists, reach out to their support team for assistance.

Mobile Banking: The Future of Online Banking

Mobile banking has revolutionized the way people manage their finances. With the ability to perform transactions on the go, mobile banking offers unparalleled convenience. Here are some key features of mobile banking:

Real-Time Notifications

Receive instant alerts for account activity, such as deposits, withdrawals, and bill payments. This helps you stay informed and detect any unauthorized transactions quickly.

Remote Check Deposits

Many banks now offer remote check deposit services, allowing users to deposit checks by simply taking a photo through their mobile app.

Customer Support

Mobile banking apps often include chat or call support options, enabling users to resolve issues directly from their devices.

Benefits of Using 3rd Bank Online Services

Using third-party banking platforms offers several advantages:

- Centralized Account Management: View and manage multiple accounts from different banks in one place.

- Financial Insights: Gain insights into spending habits and budgeting through detailed reports and analytics.

- Automated Transactions: Schedule payments and transfers to ensure timely bill payments and fund transfers.

Risks Associated with Online Banking

While online banking provides convenience, it also comes with certain risks. Here are some potential threats to be aware of:

Phishing Scams

Cybercriminals often use phishing emails or fake websites to trick users into revealing their login credentials. Always verify the authenticity of emails and links before clicking on them.

Malware Attacks

Malicious software can compromise your device and steal sensitive information. Install reputable antivirus software and keep it updated to protect against malware.

Data Breaches

Even with robust security measures, banks can fall victim to data breaches. Regularly monitor your account for any suspicious activity and report it immediately to your bank.

Best Practices for Safe Banking

To ensure a secure online banking experience, follow these best practices:

Create Strong Passwords

Use a combination of uppercase and lowercase letters, numbers, and special characters to create strong, unique passwords for each account.

Avoid Sharing Credentials

Never share your login credentials with anyone, including family members or friends. This helps prevent unauthorized access to your account.

Regularly Monitor Account Activity

Check your account statements regularly for any unauthorized transactions. Report any suspicious activity to your bank immediately.

Frequently Asked Questions

Here are some common questions related to "5 3rd bank log in":

- What should I do if I forget my password? Use the "Forgot Password" feature to reset your password via email or text message.

- Is it safe to use public Wi-Fi for online banking? It's generally not recommended. Use a secure connection or a VPN if you must use public Wi-Fi.

- How can I protect my account from phishing scams? Verify the authenticity of emails and links before clicking on them. Avoid sharing personal information over email.

Conclusion

Understanding the "5 3rd bank log in" process is crucial for managing your finances securely in today's digital world. By following the steps outlined in this guide and implementing best practices for online banking, you can protect your account from potential threats.

We encourage you to share this article with others who may benefit from it. If you have any questions or feedback, feel free to leave a comment below. Stay informed, stay secure, and enjoy the convenience of online banking!

For further reading, check out our other articles on financial management and cybersecurity. Together, we can build a safer digital future for everyone.