Understanding the banking system can sometimes be confusing, especially when it comes to terms like ABA and routing numbers. Many people often wonder, "Are ABA and routing numbers the same?" This article will delve into this topic and provide clarity on the matter. Whether you're managing your finances or simply curious about banking terminology, you're in the right place.

Banking terms can seem overwhelming at first glance, but they play a crucial role in how financial transactions are processed. Knowing the difference between ABA and routing numbers can help you navigate banking procedures more efficiently. This guide aims to demystify these terms and their functions.

As we explore the similarities and differences between ABA and routing numbers, you'll gain a better understanding of how they work in the context of financial transactions. Let's dive in and answer the question: Are ABA and routing numbers the same?

Read also:Discover The Enchanting Treehouse Vineyard In Monroe North Carolina

Table of Contents

- What is an ABA Number?

- Routing Number Definition

- ABA vs Routing Number: Are They the Same?

- History of ABA and Routing Numbers

- How to Find Your ABA/Routing Number

- Common Uses of Routing Numbers

- Security Concerns with Routing Numbers

- Differences in Global Banking Systems

- Important Tips for Users

- Conclusion and Next Steps

What is an ABA Number?

The ABA number, also known as the American Bankers Association routing number, is a nine-digit code used by financial institutions in the United States. This number is essential for facilitating electronic transactions, such as direct deposits and wire transfers. It identifies the specific financial institution responsible for a transaction.

Key Features of an ABA Number

- It consists of nine digits.

- It is used primarily for domestic transactions within the U.S.

- Each bank or credit union has its unique ABA number.

For example, if you're setting up a direct deposit for your paycheck, the ABA number ensures that the funds are directed to the correct bank or credit union. This number is crucial for ensuring accuracy and security in financial transactions.

Routing Number Definition

A routing number is essentially the same as an ABA number. It is a nine-digit code that identifies the specific bank or financial institution involved in a transaction. While the term "routing number" is more commonly used in everyday language, it refers to the same concept as the ABA number.

How Routing Numbers Work

- Routing numbers are assigned by the American Bankers Association (ABA).

- They are used in both electronic and paper-based transactions.

- Each routing number corresponds to a unique bank or credit union branch.

When you make a payment through a check or an electronic transfer, the routing number ensures that the transaction is routed to the correct financial institution. This system helps streamline the banking process and minimizes errors.

ABA vs Routing Number: Are They the Same?

The short answer is yes, ABA and routing numbers are the same. Both terms refer to the nine-digit code used to identify financial institutions in the United States. However, the terminology may vary depending on the context or institution.

Why the Confusion?

- Different banks may use different terms to describe the same concept.

- Some financial institutions may refer to it as an "ABA routing number" or simply a "routing number."

- Historically, the term "ABA number" was used more frequently, but "routing number" has become more common in recent years.

In practice, whether you see the term ABA number or routing number, they both serve the same purpose. The important thing is to ensure that you have the correct number for your specific bank or credit union.

Read also:Quality Inn Oceanfront Hotel The Ultimate Guide For Your Coastal Getaway

History of ABA and Routing Numbers

The concept of ABA and routing numbers dates back to 1910 when the American Bankers Association introduced the system to facilitate check processing. Over time, the system evolved to include electronic transactions, making it an integral part of modern banking.

Key Milestones in the Development of ABA/Routing Numbers

- 1910: The ABA introduced the routing number system for check processing.

- 1950s: The system expanded to include electronic transactions.

- 2000s: The adoption of digital banking increased the reliance on routing numbers for various financial activities.

This historical development highlights the importance of ABA and routing numbers in ensuring efficient and secure financial transactions. As technology continues to evolve, these numbers remain a cornerstone of the banking system.

How to Find Your ABA/Routing Number

Finding your ABA or routing number is a straightforward process. There are several methods you can use to locate this crucial information.

Methods to Find Your Routing Number

- Check Your Checks: The routing number is typically printed on the bottom left corner of your checks.

- Online Banking: Most banks provide your routing number in the account details section of their online banking platforms.

- Bank Website: Many banks list their routing numbers on their official websites for customer convenience.

It's essential to ensure that you have the correct routing number for your specific bank or credit union. Using the wrong number can result in failed transactions or delays in processing.

Common Uses of Routing Numbers

Routing numbers are used in a variety of financial transactions. Understanding their common uses can help you navigate the banking system more effectively.

Primary Uses of Routing Numbers

- Direct Deposits: Ensures that your paycheck or other income is deposited into the correct account.

- Wire Transfers: Facilitates the transfer of funds between accounts at different banks.

- Bill Payments: Allows you to pay bills automatically from your bank account.

These uses demonstrate the versatility and importance of routing numbers in modern banking. They ensure that transactions are processed accurately and efficiently.

Security Concerns with Routing Numbers

While routing numbers are essential for financial transactions, they also pose potential security risks. It's crucial to protect this information to prevent unauthorized access to your accounts.

Best Practices for Protecting Your Routing Number

- Do not share your routing number with untrusted sources.

- Monitor your bank statements regularly for any suspicious activity.

- Use secure methods for transmitting routing numbers, such as encrypted email or secure messaging platforms.

By following these best practices, you can help safeguard your financial information and minimize the risk of fraud or identity theft.

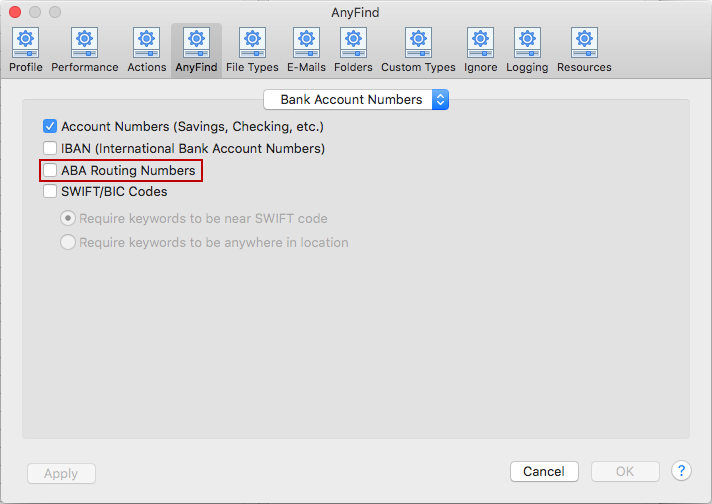

Differences in Global Banking Systems

While ABA and routing numbers are specific to the United States, other countries have their own systems for identifying financial institutions. Understanding these differences can be helpful if you engage in international transactions.

Examples of Global Banking Identification Systems

- IBAN (International Bank Account Number): Used in Europe and other regions for international transactions.

- SWIFT/BIC Codes: Facilitate global wire transfers between banks.

- BSB Codes: Used in Australia to identify specific branches of financial institutions.

These systems highlight the diversity of banking practices around the world and the importance of understanding local requirements when conducting international transactions.

Important Tips for Users

To make the most of your banking experience, here are some important tips to keep in mind when dealing with ABA and routing numbers.

Top Tips for Managing Routing Numbers

- Always double-check the routing number before initiating a transaction.

- Keep your routing number in a secure location to prevent unauthorized access.

- Stay informed about any changes to your bank's routing number, as mergers or acquisitions may result in updates.

By following these tips, you can ensure that your financial transactions are processed smoothly and securely.

Conclusion and Next Steps

In conclusion, the question "Are ABA and routing numbers the same?" can be confidently answered with a resounding yes. Both terms refer to the nine-digit code used to identify financial institutions in the United States. Understanding this concept is essential for managing your finances effectively and securely.

To take the next steps, consider reviewing your bank's policies regarding routing numbers and ensuring that you have the correct information for all your financial accounts. Additionally, explore other resources available on our website to deepen your knowledge of banking and finance.

We invite you to leave a comment or share this article with others who may find it helpful. Your feedback is valuable to us, and we're always here to assist you with any questions or concerns you may have about ABA and routing numbers.