The Commonwealth of Virginia Department of Taxation plays a pivotal role in managing the fiscal responsibilities of the state. Whether you're a resident, business owner, or simply interested in understanding how Virginia handles its taxation system, this article will provide you with an in-depth exploration of its functions and services. As one of the most important state agencies, the Department of Taxation ensures that all tax-related obligations are met efficiently and effectively.

Virginia's tax system is designed to support the state's infrastructure, public services, and overall economic development. This department oversees various types of taxes, including income tax, sales tax, and corporate taxes. By understanding the workings of this department, you can ensure compliance and avoid potential penalties.

This article aims to provide a detailed overview of the Commonwealth of Virginia Department of Taxation. We will explore its responsibilities, the types of taxes it manages, and the resources available to taxpayers. Whether you're looking to file your taxes, resolve an issue, or gain a deeper understanding of the state's tax policies, this guide is here to help.

Read also:Holiday Inn Montego Bay All Inclusive Your Ultimate Paradise Getaway

Table of Contents

- Overview of the Commonwealth of Virginia Department of Taxation

- A Brief History of the Department of Taxation

- Key Responsibilities of the Department

- Types of Taxes Managed by the Department

- The Tax Filing Process in Virginia

- Resources Available for Taxpayers

- Common Tax Issues and How to Resolve Them

- Business Taxes in Virginia

- Understanding Tax Penalties and Compliance

- The Future of Taxation in Virginia

Overview of the Commonwealth of Virginia Department of Taxation

The Commonwealth of Virginia Department of Taxation is a state agency responsible for administering and enforcing tax laws within the state. Established to ensure fair and efficient tax collection, this department plays a crucial role in funding essential public services such as education, healthcare, transportation, and public safety.

One of the primary functions of the department is to collect state income taxes, sales taxes, and other forms of revenue. Additionally, it provides guidance and resources to taxpayers to help them understand their obligations and navigate the tax filing process.

In recent years, the department has embraced digital transformation, offering online services and tools to simplify the tax experience for residents and businesses alike. This shift has made it easier for taxpayers to file returns, pay taxes, and access important information.

How the Department Impacts Residents

The Commonwealth of Virginia Department of Taxation directly impacts every resident through its tax collection efforts. By ensuring compliance with state tax laws, the department helps maintain the financial stability of the state. Below are some key ways the department affects residents:

- Collection of state income taxes

- Administration of sales and use taxes

- Management of fuel and motor vehicle taxes

- Providing resources for tax planning and compliance

A Brief History of the Department of Taxation

The Commonwealth of Virginia Department of Taxation has a rich history that dates back to the early days of statehood. Initially, tax collection was managed by local governments, but as the state grew, the need for a centralized tax administration became apparent.

In the early 20th century, the department was officially established to streamline tax collection and ensure consistency across the state. Over the years, it has evolved to meet the changing needs of the population and the economy. Today, the department leverages advanced technology and data analytics to improve efficiency and transparency.

Read also:Can You Refund On Steam A Comprehensive Guide To Steam Refunds

Throughout its history, the department has remained committed to serving the people of Virginia by providing accurate information and fair enforcement of tax laws.

Key Milestones in the Department's History

Here are some significant milestones in the development of the Commonwealth of Virginia Department of Taxation:

- 1928: Establishment of the Department of Taxation

- 1950s: Introduction of state income tax

- 1980s: Expansion of electronic filing options

- 2000s: Adoption of advanced data systems for tax administration

Key Responsibilities of the Department

The Commonwealth of Virginia Department of Taxation has several key responsibilities that ensure the state's fiscal health. These responsibilities include:

- Administering state tax laws and regulations

- Collecting taxes from individuals and businesses

- Providing taxpayer education and support

- Enforcing compliance with tax laws

By fulfilling these responsibilities, the department ensures that the state has the necessary revenue to fund critical services and infrastructure projects.

Taxpayer Support Services

The department offers a range of support services to assist taxpayers with their obligations. These services include:

- Online resources for tax filing and payment

- Customer service helplines for inquiries

- Public workshops and seminars on tax topics

- Publication of tax guides and FAQs

Types of Taxes Managed by the Department

The Commonwealth of Virginia Department of Taxation oversees various types of taxes, each serving a specific purpose. Below is an overview of the main taxes managed by the department:

- Personal Income Tax: Levied on the income of individuals residing in Virginia.

- Sales and Use Tax: Applied to the purchase of goods and services within the state.

- Corporate Income Tax: Collected from businesses operating in Virginia.

- Fuel Tax: Charged on the sale of gasoline and diesel fuel.

- Motor Vehicle Taxes: Includes taxes on vehicle registration and titles.

Each of these taxes contributes to the overall revenue of the state, supporting essential services and infrastructure development.

How These Taxes Impact the Economy

The taxes managed by the Commonwealth of Virginia Department of Taxation play a crucial role in the state's economy. By generating revenue from various sources, the department helps fund public services that benefit residents and businesses alike. This includes:

- Investment in education and workforce development

- Infrastructure improvements such as roads and bridges

- Healthcare and social services programs

- Public safety initiatives

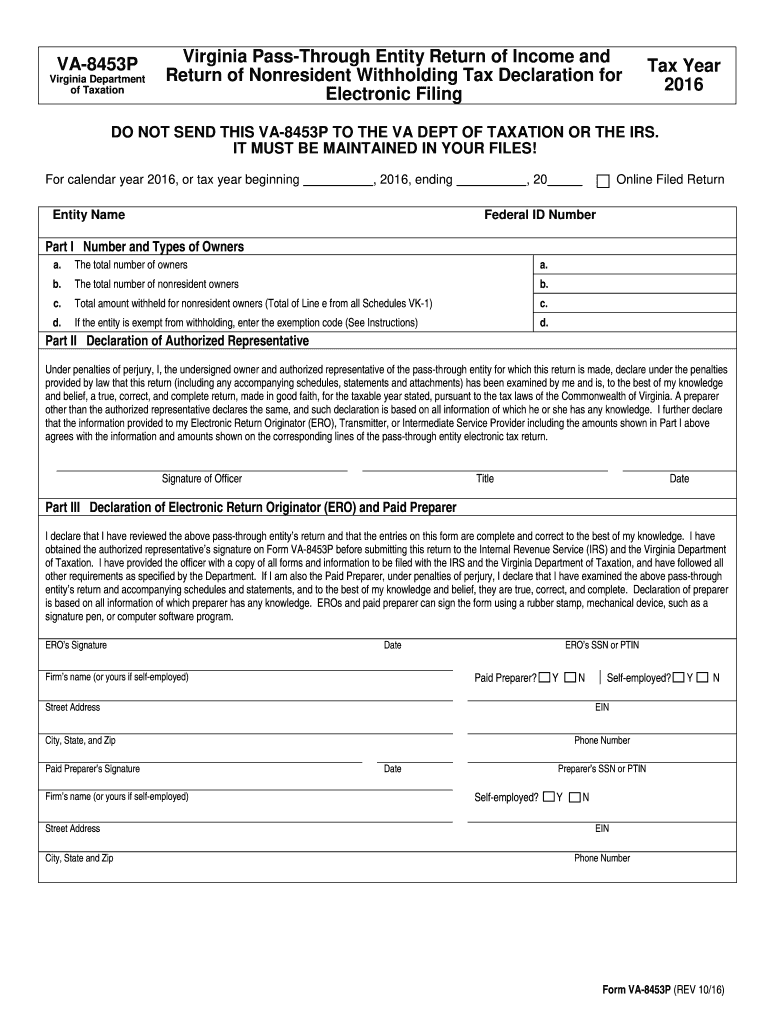

The Tax Filing Process in Virginia

Filing taxes in Virginia is a straightforward process, thanks to the resources provided by the Commonwealth of Virginia Department of Taxation. Taxpayers can choose to file their returns electronically or by mail, depending on their preference.

Electronic filing is the most popular method, as it offers several advantages, including faster processing times and reduced errors. The department's website provides detailed instructions and tools to assist taxpayers with the filing process.

For those who prefer traditional methods, mailing in a paper return is still an option. However, it is important to ensure that all forms are completed accurately and submitted by the deadline to avoid penalties.

Important Deadlines to Remember

Here are some key deadlines for taxpayers in Virginia:

- April 15: Deadline for filing state income tax returns

- January 31: Deadline for receiving W-2 forms from employers

- Quarterly estimates: Due dates for estimated tax payments

Resources Available for Taxpayers

The Commonwealth of Virginia Department of Taxation offers a wealth of resources to help taxpayers understand and meet their obligations. These resources include:

- Online tax calculators and estimators

- Comprehensive tax guides and publications

- Customer service support through phone and email

- Workshops and seminars on tax-related topics

By utilizing these resources, taxpayers can gain a better understanding of their responsibilities and avoid common mistakes that could lead to penalties.

How to Access These Resources

Taxpayers can access the resources provided by the department through several channels:

- The department's official website

- Local tax offices

- Public libraries and community centers

Common Tax Issues and How to Resolve Them

Despite the availability of resources, taxpayers may encounter issues when dealing with the Commonwealth of Virginia Department of Taxation. Some common issues include:

- Errors in tax returns

- Unpaid or overdue taxes

- Disputes over tax assessments

- Identity theft and fraud

To resolve these issues, taxpayers should contact the department's customer service team or seek legal advice if necessary. Prompt action is essential to avoid further complications.

Steps to Resolve Tax Issues

Here are some steps taxpayers can take to address common tax issues:

- Contact the department's customer service for assistance

- Gather all relevant documents and information

- Submit any necessary forms or appeals

- Follow up regularly to ensure the issue is resolved

Business Taxes in Virginia

Businesses operating in Virginia are subject to various taxes managed by the Commonwealth of Virginia Department of Taxation. These include corporate income tax, sales tax, and unemployment taxes. Understanding these obligations is crucial for businesses to remain compliant and avoid penalties.

The department provides specialized resources and support for businesses, including guidance on tax planning and compliance. By taking advantage of these resources, businesses can ensure they meet all their tax obligations efficiently.

Key Business Tax Obligations

Here are some of the key tax obligations for businesses in Virginia:

- Corporate income tax filings

- Collection and remittance of sales tax

- Unemployment tax contributions

Understanding Tax Penalties and Compliance

Failure to comply with tax laws can result in penalties imposed by the Commonwealth of Virginia Department of Taxation. These penalties may include fines, interest charges, and legal action in severe cases. To avoid penalties, taxpayers should ensure they meet all their obligations on time and accurately.

The department offers payment plans and relief programs for taxpayers experiencing financial difficulties. By communicating openly with the department, taxpayers can often resolve issues before penalties are imposed.

Avoiding Common Compliance Mistakes

To avoid compliance mistakes, taxpayers should:

- Keep accurate records of income and expenses

- File returns by the deadline

- Pay taxes on time

- Seek professional advice if needed

The Future of Taxation in Virginia

As technology continues to advance, the Commonwealth of Virginia Department of Taxation is likely to adopt new tools and strategies to enhance its operations. This may include expanded use of artificial intelligence, blockchain technology, and data analytics to improve efficiency and accuracy in tax administration.

In addition, the department may explore new revenue sources and tax policies to address the evolving needs of the state. By staying informed about these developments, taxpayers can better prepare for the future of taxation in Virginia.

Emerging Trends in Taxation

Some emerging trends in taxation that may impact Virginia include:

- Increased focus on digital taxation

- Expansion of environmental taxes

- Enhanced data security measures

Conclusion

The Commonwealth of Virginia Department of Taxation plays a vital role in the state's fiscal health by administering and enforcing tax laws. Through its various programs and resources, the department ensures that residents and businesses meet their obligations efficiently and effectively.

By understanding the functions and responsibilities of the department, taxpayers can avoid common issues and ensure compliance. We encourage you to explore the resources available and take advantage of the tools provided to simplify your tax experience.

We invite you to share this article with others who may benefit from the information provided. For more insights into taxation and related topics, please explore our other articles on the website.