Taxation is an essential part of every economy, and understanding state taxes, such as VA state tax, is crucial for both residents and businesses operating in Virginia. Whether you're filing your first tax return or running a business in the state, being knowledgeable about Virginia's tax structure can help you make informed financial decisions. In this article, we will delve into the intricacies of VA state tax, providing you with everything you need to know to navigate this complex system.

Virginia has a well-established tax framework that includes income tax, sales tax, property tax, and other levies. Each of these taxes plays a significant role in funding public services and infrastructure. By gaining a deeper understanding of these taxes, you can better plan your finances and avoid potential penalties or complications during tax season.

This article will explore the different types of VA state tax, how they are calculated, and the various exemptions and deductions available. Additionally, we'll provide practical tips and strategies to help you optimize your tax obligations while ensuring compliance with state regulations.

Read also:Wwwnjmvgov Online Services A Comprehensive Guide To Streamline Your Dmv Experience

Table of Contents

- Introduction to VA State Tax

- VA Income Tax Overview

- Sales and Use Tax

- Property Tax in Virginia

- Business Taxes

- Tax Exemptions and Deductions

- Filing VA State Tax Returns

- Penalties for Non-Compliance

- Resources for Taxpayers

- Conclusion and Next Steps

Introduction to VA State Tax

The state of Virginia imposes several types of taxes on its residents and businesses. These taxes are designed to fund essential public services, including education, healthcare, transportation, and public safety. Understanding VA state tax is crucial for anyone living or working in the state, as it directly impacts your financial obligations and planning.

Why Understanding VA State Tax Matters

Virginia's tax system is structured to ensure equitable distribution of the tax burden among residents and businesses. By familiarizing yourself with the different types of taxes and their implications, you can:

- Plan your finances more effectively.

- Avoid penalties and interest charges for late or incorrect filings.

- Take advantage of available deductions and credits.

For businesses, understanding VA state tax is even more critical, as non-compliance can lead to severe financial consequences and damage to your reputation.

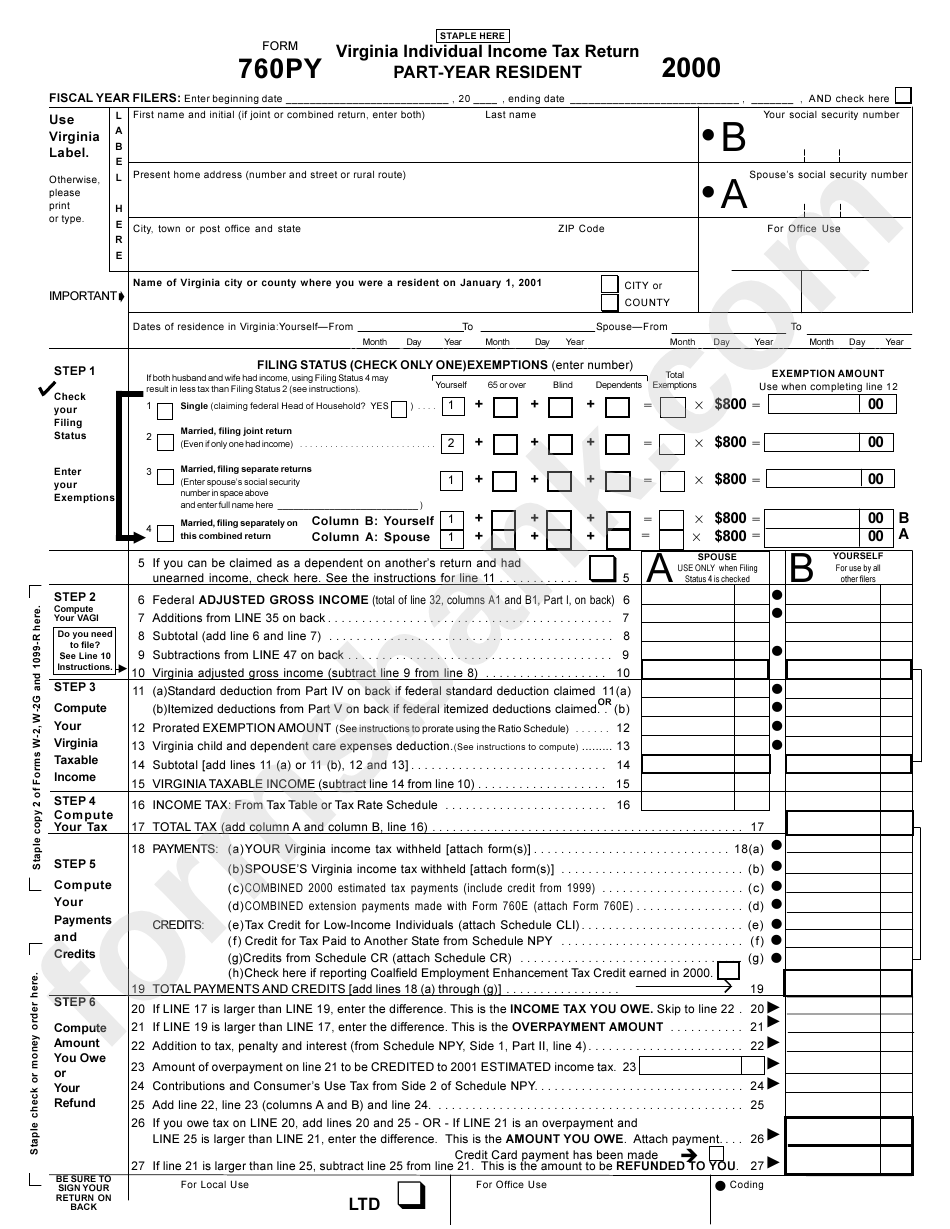

VA Income Tax Overview

Virginia imposes a personal income tax on residents, which is calculated based on your federal adjusted gross income (AGI). The state uses a progressive tax rate system, meaning that higher income levels are taxed at higher rates.

Virginia Income Tax Rates

As of the latest tax year, Virginia's income tax rates are as follows:

- 2% on the first $3,000 of taxable income.

- 3% on income between $3,001 and $5,000.

- 5% on income exceeding $5,000.

These rates are subject to change, so it's essential to stay updated on any legislative updates that may affect your tax liability.

Read also:Jami Gertz This Is Us A Comprehensive Look At The Actresss Life And Career

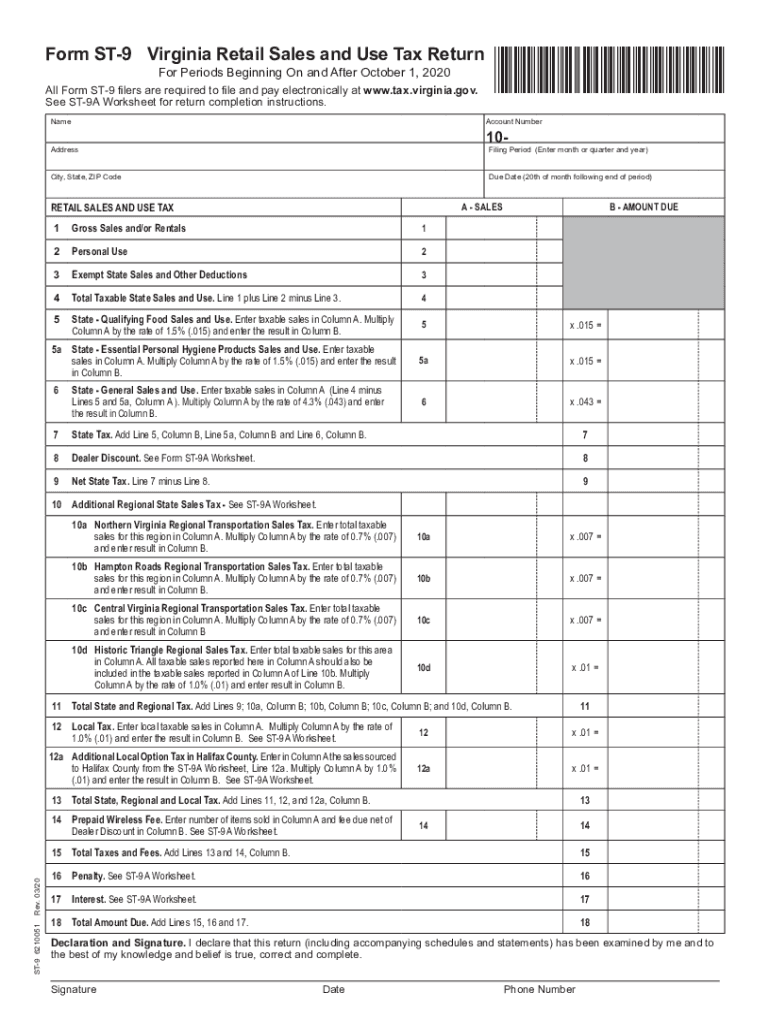

Sales and Use Tax

The sales and use tax in Virginia is another critical component of the state's tax structure. This tax is levied on the sale of goods and certain services within the state.

Current Sales Tax Rate

As of the latest data, the general sales tax rate in Virginia is 4.3%. However, certain localities may impose additional sales taxes, bringing the total rate to 6% or higher in some areas.

It's important to note that some goods and services are exempt from sales tax, including prescription medications and certain agricultural products.

Property Tax in Virginia

Property tax is another significant source of revenue for the state of Virginia. This tax is levied on real estate and personal property owned by individuals and businesses.

How Property Tax is Calculated

Property tax in Virginia is calculated based on the assessed value of the property. The tax rate varies by locality, with some areas imposing higher rates than others. Property owners receive an annual tax bill, which must be paid by the specified deadline to avoid penalties.

Homestead exemptions are available for qualifying homeowners, reducing their property tax liability.

Business Taxes

Businesses operating in Virginia are subject to various taxes, including corporate income tax, franchise tax, and sales tax. These taxes are designed to ensure that businesses contribute to the state's revenue while also encouraging economic growth.

Corporate Income Tax Rates

Virginia imposes a corporate income tax on businesses operating within the state. The current tax rate is 6%, applied to the corporation's taxable income. Businesses must file annual tax returns and pay any taxes owed by the specified deadline.

Small businesses may qualify for certain exemptions or reduced tax rates, depending on their size and industry.

Tax Exemptions and Deductions

Virginia offers several exemptions and deductions to help taxpayers reduce their tax liability. These include:

- Standard deduction: Available to all taxpayers who do not itemize their deductions.

- Itemized deductions: Allow taxpayers to deduct specific expenses, such as mortgage interest and charitable contributions.

- Homestead exemptions: Reduce property tax liability for qualifying homeowners.

- Retirement income exclusions: Allow taxpayers over a certain age to exclude a portion of their retirement income from taxation.

It's essential to review these exemptions and deductions carefully to ensure you're taking full advantage of them.

Filing VA State Tax Returns

Taxpayers in Virginia must file annual state tax returns to report their income and pay any taxes owed. The deadline for filing is typically April 15th, aligning with the federal tax deadline.

Electronic Filing Options

Virginia encourages electronic filing through its official tax portal, which offers secure and convenient submission of tax returns. Taxpayers can also use third-party software to prepare and submit their returns electronically.

Paper filing is still an option for those who prefer it, but electronic filing is generally faster and reduces the risk of errors.

Penalties for Non-Compliance

Failing to comply with VA state tax regulations can result in significant penalties and interest charges. These penalties may include:

- Late filing fees: Charged for failing to submit your tax return by the deadline.

- Late payment penalties: Applied when taxes owed are not paid on time.

- Interest charges: Accumulated on unpaid taxes until the balance is settled.

To avoid these penalties, it's crucial to stay organized and file your taxes promptly and accurately.

Resources for Taxpayers

Virginia offers several resources to help taxpayers understand and comply with state tax regulations. These include:

- Virginia Department of Taxation website: Provides comprehensive information on state taxes and filing procedures.

- Free tax preparation assistance: Available through local organizations for low-income taxpayers.

- Taxpayer assistance centers: Offer in-person support and guidance for those who need additional help.

Utilizing these resources can help you navigate the complexities of VA state tax and ensure compliance with all applicable regulations.

Conclusion and Next Steps

Understanding VA state tax is essential for anyone living or working in Virginia. By familiarizing yourself with the different types of taxes, their implications, and available exemptions and deductions, you can better plan your finances and avoid potential complications during tax season.

Take the following steps to ensure you're fully prepared for VA state tax obligations:

- Review your income, expenses, and deductions to determine your tax liability.

- Utilize available resources, such as the Virginia Department of Taxation website, to stay informed.

- File your tax return promptly and accurately to avoid penalties and interest charges.

We encourage you to share this article with others who may benefit from the information and to explore additional resources on our website. Your feedback and questions are always welcome, so feel free to leave a comment or contact us directly for further assistance.