Property tax protests are an essential aspect of homeownership in Travis County, Texas, providing residents with the opportunity to challenge their property tax assessments and potentially lower their tax burden. With property taxes being a significant financial responsibility, it’s crucial for homeowners to be well-informed about the process, timelines, and strategies involved in filing a property tax protest. Understanding your rights and obligations can help you navigate this complex system effectively.

Travis County, Texas, like many other counties across the United States, operates under a property tax system designed to fund local services and infrastructure. However, many homeowners find themselves questioning the accuracy of their property valuations, leading to dissatisfaction and financial strain. This article aims to provide a detailed overview of the property tax protest process in Travis County, empowering you with the knowledge to protect your financial interests.

By the end of this guide, you will have a clear understanding of how property tax protests work, the steps involved, and the resources available to support your case. Whether you’re a new homeowner or a long-time resident, this information is invaluable for anyone seeking to manage their property tax liabilities effectively.

Read also:Exploring The City Of Boston Traffic Insights Solutions And Expert Advice

Table of Contents

- Introduction to Property Tax Protest

- Overview of Property Taxes in Travis County

- The Property Tax Protest Process

- Important Filing Deadlines

- Understanding Property Valuation Methods

- Gathering Evidence for Your Protest

- Common Issues in Property Tax Assessments

- The Appeals Process

- Resources for Homeowners

- Conclusion and Call to Action

Introduction to Property Tax Protest

In Travis County, Texas, property tax protests serve as a legal mechanism for homeowners to contest the assessed value of their property. This process is critical for ensuring that property owners are not overcharged for their tax obligations. By understanding the nuances of property tax protests, homeowners can make informed decisions about their financial futures.

Property tax protests are not only about reducing tax burdens but also about advocating for fair and equitable treatment under the law. Homeowners in Travis County have the right to question and challenge the accuracy of their property valuations, and this guide will walk you through the steps necessary to do so effectively.

Why Protest Property Taxes?

There are several reasons why homeowners might choose to protest their property taxes. Some common motivations include:

- Disagreement with the assessed value of the property

- Belief that similar properties in the area are taxed at lower rates

- Concerns about inaccuracies in the property records

Understanding these motivations can help homeowners determine whether filing a protest is the right course of action for them.

Overview of Property Taxes in Travis County

Property taxes in Travis County are a significant source of revenue for local governments, funding essential services such as public education, law enforcement, and infrastructure development. The tax rate is determined annually based on the needs of the county and its municipalities.

Homeowners in Travis County are required to pay property taxes based on the assessed value of their property. This value is determined by the Travis Central Appraisal District (TCAD), which evaluates properties annually. The accuracy of these assessments is crucial, as they directly impact the amount of taxes owed by property owners.

Read also:Exploring Quality Inn Mammoth Lakes California Your Ultimate Travel Guide

How Property Taxes Are Calculated

The calculation of property taxes involves several factors:

- Assessed value of the property

- Local tax rates

- Exemptions or deductions applicable to the property owner

Understanding how these factors interact is essential for homeowners who wish to challenge their property tax assessments.

The Property Tax Protest Process

Filing a property tax protest in Travis County involves several key steps. The process begins with a thorough review of the property’s assessed value and continues through the submission of a formal protest and, if necessary, an appeal to a higher authority.

Homeowners must ensure they follow the correct procedures and meet all deadlines to avoid any potential complications. This section will provide a detailed breakdown of the steps involved in the protest process.

Step-by-Step Guide to Filing a Protest

Here is a step-by-step guide to filing a property tax protest in Travis County:

- Review your property tax notice and compare it to recent sales data for similar properties.

- Identify any discrepancies or inaccuracies in the assessed value.

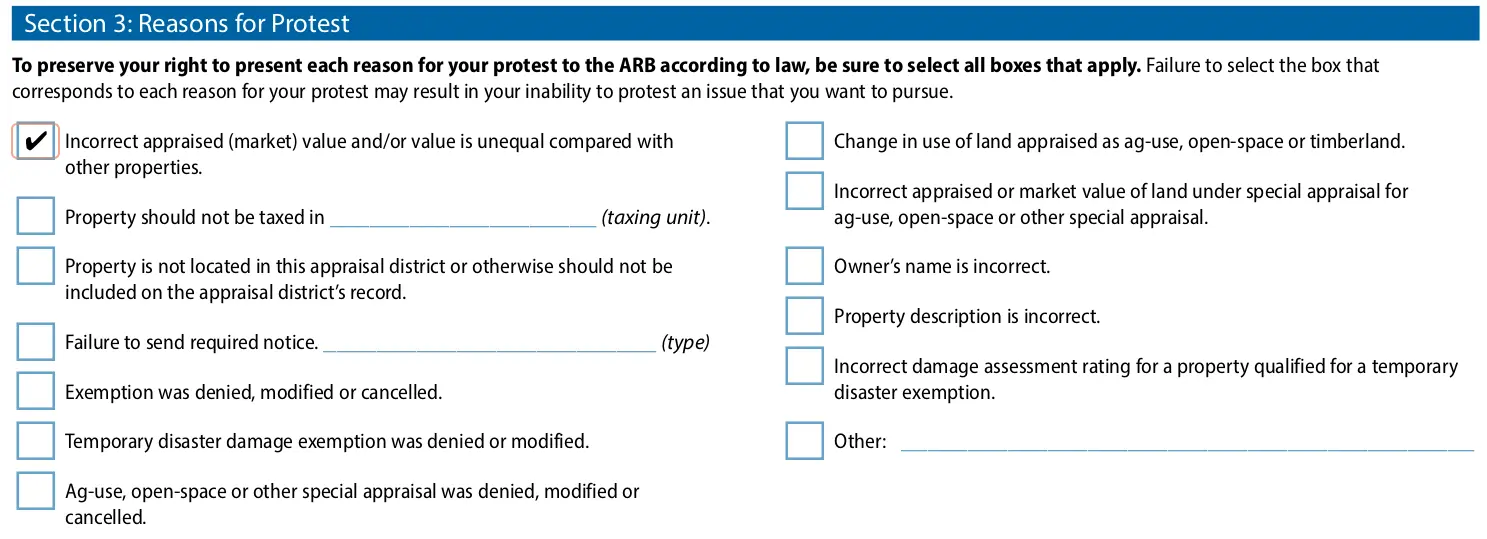

- Complete the protest form provided by the Travis Central Appraisal District.

- Submit the completed form by the specified deadline.

- Attend the protest hearing and present your evidence to the appraisal review board.

Following these steps diligently will increase your chances of a successful protest.

Important Filing Deadlines

Timeliness is crucial when it comes to property tax protests in Travis County. Homeowners must be aware of the deadlines associated with the protest process to ensure their rights are protected.

In Travis County, the deadline for filing a property tax protest is typically May 31st of each year. However, it’s important to verify this date annually, as it may vary slightly depending on the calendar year.

Consequences of Missing Deadlines

Missing the filing deadline for a property tax protest can result in the loss of your right to challenge the assessed value of your property for that tax year. Therefore, it’s essential to stay organized and submit all necessary documentation well before the deadline.

Understanding Property Valuation Methods

The accuracy of property valuations is a critical factor in the property tax protest process. Travis County utilizes several methods to determine the assessed value of properties, each with its own set of advantages and limitations.

Homeowners who understand these methods can better assess whether their property has been fairly valued. This knowledge is essential for building a strong case during the protest process.

Common Valuation Methods

Some of the most common valuation methods used in Travis County include:

- Market approach: comparing the property to similar properties that have recently sold

- Cost approach: estimating the cost to replace the property minus depreciation

- Income approach: analyzing the property’s potential to generate income

Each method provides a different perspective on the property’s value, and understanding these differences can be invaluable during a protest hearing.

Gathering Evidence for Your Protest

One of the most important aspects of a successful property tax protest is the quality and relevance of the evidence presented. Homeowners must gather and organize their evidence carefully to support their case effectively.

Some key pieces of evidence to consider include:

- Recent sales data for comparable properties

- Photos or documentation of property condition

- Expert appraisals or assessments

Providing strong, compelling evidence can significantly enhance your chances of achieving a favorable outcome.

Common Issues in Property Tax Assessments

Homeowners often encounter various issues when reviewing their property tax assessments. Identifying these problems early can help streamline the protest process and increase the likelihood of success.

Common issues include:

- Inaccurate property descriptions

- Overestimation of property value

- Failure to account for property damage or depreciation

Addressing these issues promptly is essential for ensuring a fair and accurate assessment.

The Appeals Process

If the initial protest is unsuccessful, homeowners in Travis County have the option to appeal the decision. The appeals process involves presenting your case to a higher authority, such as the State Office of Administrative Hearings (SOAH).

It’s important to note that the appeals process can be time-consuming and may require additional evidence or legal representation. Homeowners should carefully weigh the potential benefits against the costs before proceeding with an appeal.

Resources for Homeowners

Several resources are available to assist homeowners in navigating the property tax protest process in Travis County. These resources can provide valuable guidance and support throughout the process.

Some key resources include:

- Travis Central Appraisal District website

- Local legal aid organizations specializing in property tax issues

- Real estate professionals and appraisers

Taking advantage of these resources can help homeowners make informed decisions and improve their chances of success.

Conclusion and Call to Action

Property tax protests in Travis County, Texas, offer homeowners a powerful tool for ensuring fair and accurate property valuations. By understanding the process, gathering strong evidence, and utilizing available resources, homeowners can effectively challenge their property tax assessments and potentially reduce their tax burdens.

We encourage all homeowners in Travis County to take an active role in managing their property tax responsibilities. If you believe your property has been overvalued or inaccurately assessed, don’t hesitate to file a protest. Share this article with fellow homeowners, leave your thoughts in the comments, and explore other resources on our site to stay informed about property tax issues in your area.

Remember, knowledge is power, and staying informed is the key to protecting your financial interests as a homeowner in Travis County, Texas.