The ABA Transit Routing Number, commonly referred to as the Routing Transit Number (RTN), plays a pivotal role in the banking industry. It serves as a unique identifier for financial institutions, enabling seamless transactions within the United States. Understanding its function is essential for anyone engaging in banking activities, from individuals to businesses.

As the financial landscape evolves, having a clear understanding of banking terminologies like the ABA Transit Routing Number becomes increasingly important. This number ensures that funds are directed accurately and efficiently, minimizing errors in transactions. In this article, we will delve into the intricacies of the ABA Transit Routing Number, providing you with a complete guide to its purpose and usage.

Whether you're setting up direct deposits, initiating wire transfers, or configuring automatic bill payments, knowing how to locate and utilize your ABA Transit Routing Number can save you time and effort. Let's explore this critical banking tool in detail, ensuring you're well-equipped to manage your financial transactions effectively.

Read also:When Did The Plane Land In The Hudson River A Comprehensive Look At The Miracle On The Hudson

Table of Contents

- What is an ABA Transit Routing Number?

- History of ABA Transit Routing Numbers

- Structure of an ABA Transit Routing Number

- Uses of ABA Transit Routing Numbers

- Where to Find Your ABA Transit Routing Number

- Security Aspects of ABA Transit Routing Numbers

- ABA vs. IBAN: Understanding the Differences

- Why ABA Transit Routing Numbers Are Important

- Common Issues with ABA Transit Routing Numbers

- The Future of ABA Transit Routing Numbers

What is an ABA Transit Routing Number?

An ABA Transit Routing Number is a nine-digit code assigned to financial institutions in the United States. This number identifies the specific bank or credit union involved in a transaction, ensuring that funds are routed to the correct institution. The American Bankers Association (ABA) developed this system in 1910 to streamline check processing.

ABA Transit Routing Numbers are crucial for domestic transactions, such as direct deposits, bill payments, and wire transfers. Each bank or credit union has its unique ABA Transit Routing Number, making it an indispensable tool for financial operations.

How Does the ABA Transit Routing Number Work?

When you initiate a transaction, the ABA Transit Routing Number acts as a digital address, directing the funds to the correct bank or credit union. For example, if you set up a direct deposit for your paycheck, your employer will need your ABA Transit Routing Number to ensure the funds are deposited into your account accurately.

History of ABA Transit Routing Numbers

The history of ABA Transit Routing Numbers dates back to 1910 when the American Bankers Association introduced them to improve the efficiency of check processing. Initially designed for manual check clearing, the system has evolved to accommodate modern electronic transactions.

Over the years, ABA Transit Routing Numbers have become integral to the U.S. banking infrastructure, supporting various financial activities, including electronic funds transfers (EFTs) and automated clearing house (ACH) transactions.

Key Milestones in the Evolution of ABA Transit Routing Numbers

- 1910: Introduction of the ABA Transit Routing Number system.

- 1950s: Adoption of magnetic ink character recognition (MICR) technology for faster processing.

- 1970s: Expansion to include electronic transactions.

- 2000s: Integration with online banking platforms.

Structure of an ABA Transit Routing Number

An ABA Transit Routing Number consists of nine digits, each serving a specific purpose. The first four digits represent the Federal Reserve Routing Symbol, identifying the Federal Reserve Bank responsible for processing transactions. The next four digits are the ABA Institution Identifier, unique to each financial institution. The final digit serves as a checksum, ensuring the number's validity.

Read also:Exploring Amc Theaters In Myrtle Beach Sc Your Ultimate Guide

For example, a typical ABA Transit Routing Number might look like this: 123456789. Breaking it down:

- 1234: Federal Reserve Routing Symbol

- 5678: ABA Institution Identifier

- 9: Checksum digit

Validating an ABA Transit Routing Number

To ensure the validity of an ABA Transit Routing Number, financial institutions use a checksum formula. This mathematical algorithm verifies the accuracy of the number, reducing the risk of errors in transactions.

Uses of ABA Transit Routing Numbers

ABA Transit Routing Numbers have numerous applications in the financial sector. Below are some of the most common uses:

- Direct Deposits: Employers use ABA Transit Routing Numbers to deposit salaries directly into employees' bank accounts.

- Bill Payments: Customers can set up automatic bill payments using their ABA Transit Routing Numbers.

- Wire Transfers: ABA Transit Routing Numbers are essential for domestic wire transfers, ensuring funds reach the intended recipient.

- ACH Transactions: Automated Clearing House (ACH) transactions rely on ABA Transit Routing Numbers for processing payments.

Domestic vs. International Transactions

While ABA Transit Routing Numbers are used for domestic transactions within the United States, international transactions typically require a SWIFT code or IBAN. Understanding the distinction between these systems is crucial for global financial activities.

Where to Find Your ABA Transit Routing Number

Locating your ABA Transit Routing Number is straightforward. You can find it in several places:

- Bank Statements: Your monthly bank statement typically includes your ABA Transit Routing Number.

- Online Banking: Most banks provide your ABA Transit Routing Number in the account details section of their online banking platform.

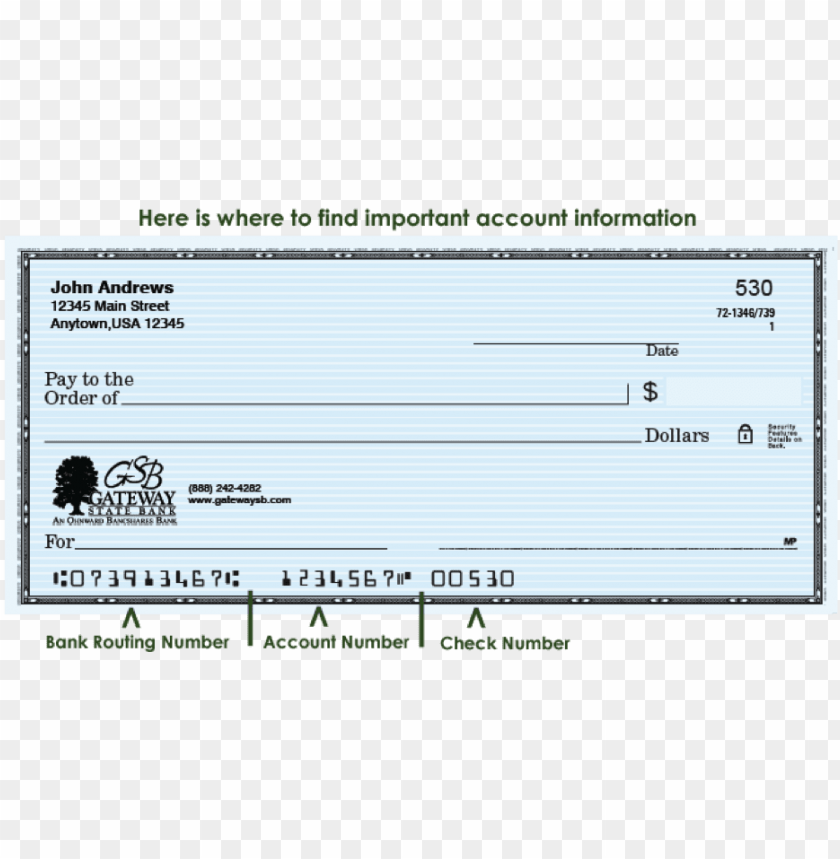

- Checks: The ABA Transit Routing Number is printed at the bottom of your checks, usually as the first set of numbers.

Tips for Identifying Your ABA Transit Routing Number on Checks

When examining your checks, the ABA Transit Routing Number appears as the first set of nine digits at the bottom. It is followed by your account number and the check number. Ensure you verify the number's accuracy before using it for transactions.

Security Aspects of ABA Transit Routing Numbers

While ABA Transit Routing Numbers are essential for financial transactions, they must be handled with care to prevent misuse. Sharing your ABA Transit Routing Number with unauthorized parties can lead to fraudulent activities.

Financial institutions implement various security measures to protect ABA Transit Routing Numbers, including encryption and two-factor authentication. As a customer, it's important to safeguard your information and report any suspicious activity immediately.

Best Practices for Protecting Your ABA Transit Routing Number

- Do not share your ABA Transit Routing Number unless necessary.

- Regularly monitor your account for unauthorized transactions.

- Enable account alerts to receive notifications of suspicious activity.

ABA vs. IBAN: Understanding the Differences

While ABA Transit Routing Numbers are used for domestic transactions in the United States, the International Bank Account Number (IBAN) facilitates international transactions. The primary difference lies in their scope and structure.

ABA Transit Routing Numbers are nine-digit codes specific to U.S. financial institutions, whereas IBANs are alphanumeric codes used globally. Understanding these differences is crucial for businesses and individuals engaging in cross-border transactions.

Key Differences Between ABA Transit Routing Numbers and IBANs

- Purpose: ABA for domestic, IBAN for international transactions.

- Structure: ABA is numeric, IBAN is alphanumeric.

- Usage: ABA for U.S. banks, IBAN for global banking.

Why ABA Transit Routing Numbers Are Important

ABA Transit Routing Numbers are vital for maintaining the integrity and efficiency of the U.S. banking system. They ensure that transactions are processed accurately and securely, minimizing the risk of errors and fraud.

For businesses and individuals alike, having a clear understanding of ABA Transit Routing Numbers is essential for managing finances effectively. Whether you're setting up direct deposits or initiating wire transfers, this number plays a critical role in your financial operations.

Impact on Financial Operations

By streamlining transactions and reducing processing times, ABA Transit Routing Numbers contribute to the overall efficiency of the banking industry. This, in turn, benefits customers by providing faster and more reliable financial services.

Common Issues with ABA Transit Routing Numbers

Despite their importance, ABA Transit Routing Numbers can sometimes cause issues. Common problems include incorrect numbers, outdated information, and security breaches.

To avoid these issues, it's crucial to verify your ABA Transit Routing Number regularly and report any discrepancies to your bank promptly. Additionally, staying informed about the latest security measures can help protect your financial information.

How to Resolve ABA Transit Routing Number Issues

- Contact your bank's customer service for assistance.

- Verify the number using official bank resources.

- Monitor your account for unauthorized transactions.

The Future of ABA Transit Routing Numbers

As technology continues to advance, the role of ABA Transit Routing Numbers in the financial industry is likely to evolve. Innovations in digital banking and blockchain technology may introduce new systems for transaction routing, potentially complementing or replacing traditional ABA Transit Routing Numbers.

Despite these advancements, ABA Transit Routing Numbers will remain a cornerstone of the U.S. banking system for the foreseeable future. Their simplicity and reliability make them an indispensable tool for financial transactions.

Emerging Trends in Transaction Routing

While ABA Transit Routing Numbers continue to dominate domestic transactions, emerging technologies like blockchain and digital currencies may reshape the landscape. These innovations could enhance transaction security and efficiency, paving the way for a more interconnected financial ecosystem.

Kesimpulan

In conclusion, understanding what an ABA Transit Routing Number is and how it functions is essential for anyone involved in banking activities. From facilitating direct deposits to ensuring secure wire transfers, this nine-digit code plays a critical role in the U.S. banking system.

We encourage you to explore further resources and stay informed about the latest developments in financial technology. If you have any questions or feedback, feel free to leave a comment below. Additionally, don't hesitate to share this article with others who may benefit from its insights. Together, let's enhance our financial literacy and secure our financial futures.

For more in-depth information on banking and finance, explore our other articles and resources. Your journey to financial empowerment starts here!

Data Source: Federal Reserve, American Bankers Association.