The US Department of Treasury Bureau of Fiscal Service check is a crucial financial instrument issued by the United States government. It plays a significant role in disbursing payments to individuals, businesses, and organizations. As a part of the broader Treasury operations, this check ensures timely and secure transactions for various federal programs and initiatives. Whether you're a recipient or simply curious about government financial processes, understanding this system is essential.

This article delves into the intricacies of the Bureau of Fiscal Service checks, exploring their purpose, issuance process, and significance in the financial ecosystem. By the end, you'll have a comprehensive understanding of how these checks function and their importance in maintaining financial stability.

From historical context to modern-day applications, we will cover everything you need to know about the US Department of Treasury Bureau of Fiscal Service check. Let's begin by breaking down the essential components and processes involved in this critical government operation.

Read also:The Hartford General Liability Quote Your Comprehensive Guide To Protecting Your Business

Table of Contents

- Introduction to Bureau of Fiscal Service Checks

- A Brief History of the Bureau of Fiscal Service

- Purpose of Treasury Checks

- The Issuance Process for Treasury Checks

- Types of Checks Issued by the Bureau

- Security Features of Treasury Checks

- Who Receives Treasury Checks?

- How to Cash a Treasury Check

- Fraud Prevention Measures

- The Future of Treasury Checks

- Conclusion

Introduction to Bureau of Fiscal Service Checks

The US Department of Treasury Bureau of Fiscal Service check is a cornerstone of federal financial transactions. This financial instrument is designed to facilitate payments for a wide range of purposes, including Social Security benefits, tax refunds, and federal employee salaries. The Bureau of Fiscal Service, a division within the Treasury Department, oversees the issuance and management of these checks.

Understanding the role of these checks is vital for anyone who interacts with federal financial systems. Whether you're a recipient or a financial professional, knowing how these checks are processed and secured can help prevent fraud and ensure timely payments.

In this section, we will explore the foundational aspects of Bureau of Fiscal Service checks, including their history, purpose, and significance in the financial landscape.

A Brief History of the Bureau of Fiscal Service

The Bureau of Fiscal Service has a rich history that dates back to the early days of the United States. Established to manage the financial operations of the federal government, the Bureau has evolved significantly over the years. Initially, its primary function was to handle government debt and revenue collection. However, as the nation's financial needs grew, so did the scope of the Bureau's responsibilities.

Today, the Bureau of Fiscal Service is a key player in the Treasury Department, responsible for issuing checks and managing electronic payments. Its evolution reflects the changing nature of financial transactions in the digital age, yet the importance of physical checks remains relevant for many recipients.

By examining the historical context, we gain insight into the Bureau's role in shaping modern financial practices and ensuring the reliability of government payments.

Read also:Original Nfl Team Names The Fascinating History And Stories Behind Them

Purpose of Treasury Checks

Key Functions of Treasury Checks

Treasury checks serve a variety of purposes, each designed to meet specific financial needs. Below are some of the primary functions of these checks:

- Social Security Payments: A significant portion of Treasury checks are issued to Social Security beneficiaries, ensuring financial support for retirees and disabled individuals.

- Tax Refunds: Taxpayers who are owed money by the IRS receive Treasury checks as part of their refund process.

- Federal Employee Compensation: Treasury checks are also used to pay federal employees, contractors, and retirees.

- Grants and Benefits: Various government programs distribute funds through Treasury checks to support education, healthcare, and other initiatives.

Each of these functions underscores the importance of Treasury checks in maintaining the financial well-being of millions of Americans.

The Issuance Process for Treasury Checks

Steps Involved in Issuing Treasury Checks

The issuance of Treasury checks is a meticulous process designed to ensure accuracy and security. Here's a breakdown of the key steps involved:

- Authorization: The Bureau of Fiscal Service receives payment authorization from the relevant federal agency or program.

- Processing: Once authorized, the Bureau processes the payment request, verifying recipient details and payment amounts.

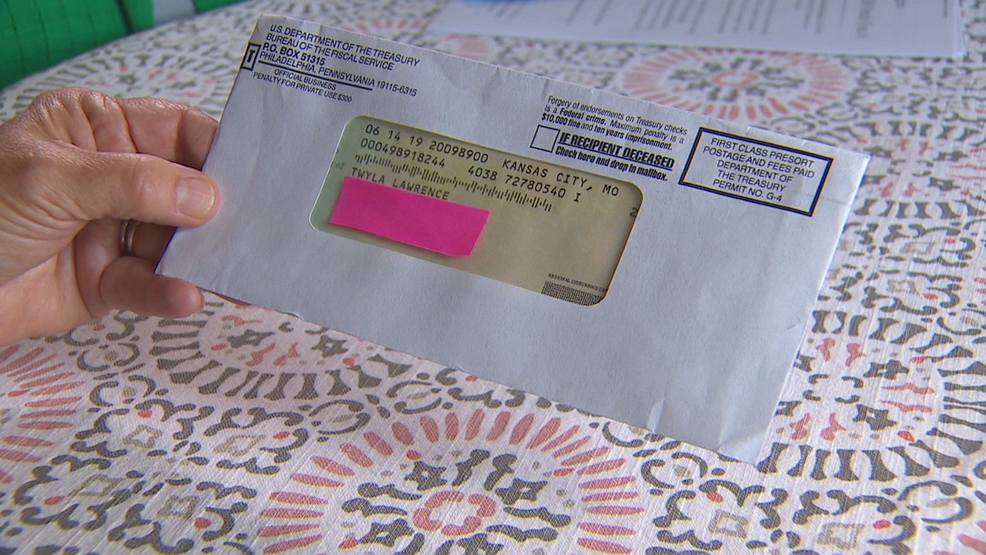

- Printing and Mailing: The checks are printed with advanced security features and mailed to recipients via secure channels.

- Tracking: The Bureau tracks the status of each check to ensure it reaches the intended recipient without delay.

This structured process minimizes errors and enhances the reliability of Treasury checks as a payment method.

Types of Checks Issued by the Bureau

Categories of Treasury Checks

The Bureau of Fiscal Service issues several types of checks, each tailored to specific purposes. Below are the most common categories:

- Personal Checks: Issued to individuals for benefits, refunds, or compensation.

- Business Checks: Used for payments to contractors, vendors, and businesses.

- Foreign Currency Checks: Designed for international transactions, often issued in foreign currencies.

- Special Purpose Checks: Created for unique situations, such as disaster relief or emergency funding.

Understanding the distinctions between these check types helps recipients and financial professionals navigate the complexities of federal payments.

Security Features of Treasury Checks

Ensuring the Integrity of Treasury Checks

Security is a top priority for the Bureau of Fiscal Service, especially when it comes to Treasury checks. These checks are equipped with advanced security features to prevent fraud and ensure authenticity. Some of the key security measures include:

- Watermarks: Unique watermarks are embedded in the check paper to verify authenticity.

- Security Threads: Special threads are woven into the paper, visible under UV light.

- Microprinting: Tiny text that is difficult to replicate without specialized equipment.

- Chemical Sensitivity: The check paper reacts to certain chemicals, revealing tampering.

These features collectively enhance the security of Treasury checks, making them one of the most reliable payment instruments available.

Who Receives Treasury Checks?

Common Recipients of Treasury Checks

Treasury checks are distributed to a diverse range of recipients, each with unique financial needs. Below are some of the most common groups:

- Social Security Beneficiaries: Retirees, disabled individuals, and survivors receive monthly payments through Treasury checks.

- Federal Employees: Both active and retired federal workers are paid via Treasury checks in certain cases.

- Contractors and Vendors: Businesses that provide goods and services to the federal government often receive payments through Treasury checks.

- Taxpayers: Individuals and businesses owed refunds by the IRS receive Treasury checks as part of the refund process.

This wide range of recipients highlights the versatility and importance of Treasury checks in the federal financial system.

How to Cash a Treasury Check

Steps for Cashing Treasury Checks

Cashing a Treasury check is a straightforward process, but certain steps must be followed to ensure a smooth transaction. Here's a guide to help you cash your Treasury check:

- Endorse the Check: Sign the back of the check exactly as your name appears on the front.

- Visit a Bank or Credit Union: Most banks and credit unions will cash Treasury checks for their customers.

- Present Identification: Bring a valid government-issued ID to verify your identity.

- Check for Restrictions: Some checks may have restrictions on where they can be cashed, so always review the details.

By following these steps, you can ensure a hassle-free experience when cashing your Treasury check.

Fraud Prevention Measures

Protecting Against Treasury Check Fraud

Fraud prevention is a critical aspect of managing Treasury checks. The Bureau of Fiscal Service employs various measures to combat fraud and protect recipients. Some of these measures include:

- Education Campaigns: The Bureau regularly educates recipients about the signs of fraud and how to avoid scams.

- Verification Processes: Recipients can verify the authenticity of their checks through the Bureau's official website or customer service.

- Reporting Mechanisms: A dedicated fraud reporting system allows recipients to report suspicious activity quickly.

By staying informed and vigilant, recipients can protect themselves from potential fraud and ensure the security of their payments.

The Future of Treasury Checks

Transitioning to Digital Payments

While Treasury checks remain an essential payment method, the Bureau of Fiscal Service is increasingly embracing digital payment solutions. This shift reflects a broader trend toward electronic transactions, driven by advancements in technology and changing consumer preferences. Some of the key developments include:

- Direct Deposit: Many recipients now opt for direct deposit, which offers faster and more secure payments.

- Electronic Funds Transfer (EFT): EFT is becoming a popular alternative to traditional checks, especially for large transactions.

- Mobile Payment Options: Emerging technologies are paving the way for mobile payment solutions, further enhancing convenience and accessibility.

Despite these advancements, Treasury checks will continue to play a vital role in federal financial operations for the foreseeable future.

Conclusion

The US Department of Treasury Bureau of Fiscal Service check is a cornerstone of federal financial transactions, ensuring timely and secure payments for millions of Americans. From Social Security benefits to tax refunds, these checks serve a wide range of purposes and remain a reliable payment instrument in an increasingly digital world.

As we've explored in this article, understanding the intricacies of Treasury checks is essential for recipients and financial professionals alike. By familiarizing yourself with the issuance process, security features, and fraud prevention measures, you can better navigate the complexities of federal payments and protect your financial interests.

We encourage you to share this article with others who may benefit from this information and explore additional resources on our website. Together, we can promote financial literacy and security for all.