The US Dollar Debt Clock has become a critical topic of discussion for economists, policymakers, and the general public alike. It represents a real-time tracker of the United States' national debt, offering insights into the financial health of the world's largest economy. As the debt continues to grow, understanding its implications is essential for anyone interested in global finance and economic stability.

For decades, the US government has relied on borrowing to fund various programs, infrastructure, and military operations. While this practice has helped sustain economic growth, it has also led to an alarming accumulation of debt. The US Dollar Debt Clock serves as a visual reminder of this growing financial burden.

In this article, we will explore the significance of the US Dollar Debt Clock, its impact on the economy, and what it means for individuals, businesses, and governments worldwide. Whether you're a finance enthusiast or simply curious about the state of global economics, this guide will provide you with valuable insights and actionable information.

Read also:Who Are The Kardashians Dad A Comprehensive Guide To The Kardashian Patriarch

Table of Contents

- What is the US Dollar Debt Clock?

- History of the US National Debt

- How the Debt Clock Works

- Factors Contributing to the US Debt

- Economic Impact of the US Debt

- Global Perspective on US Debt

- Solutions to Manage US Debt

- US Debt and Inflation

- Future Prospects of US Debt

- Conclusion and Next Steps

What is the US Dollar Debt Clock?

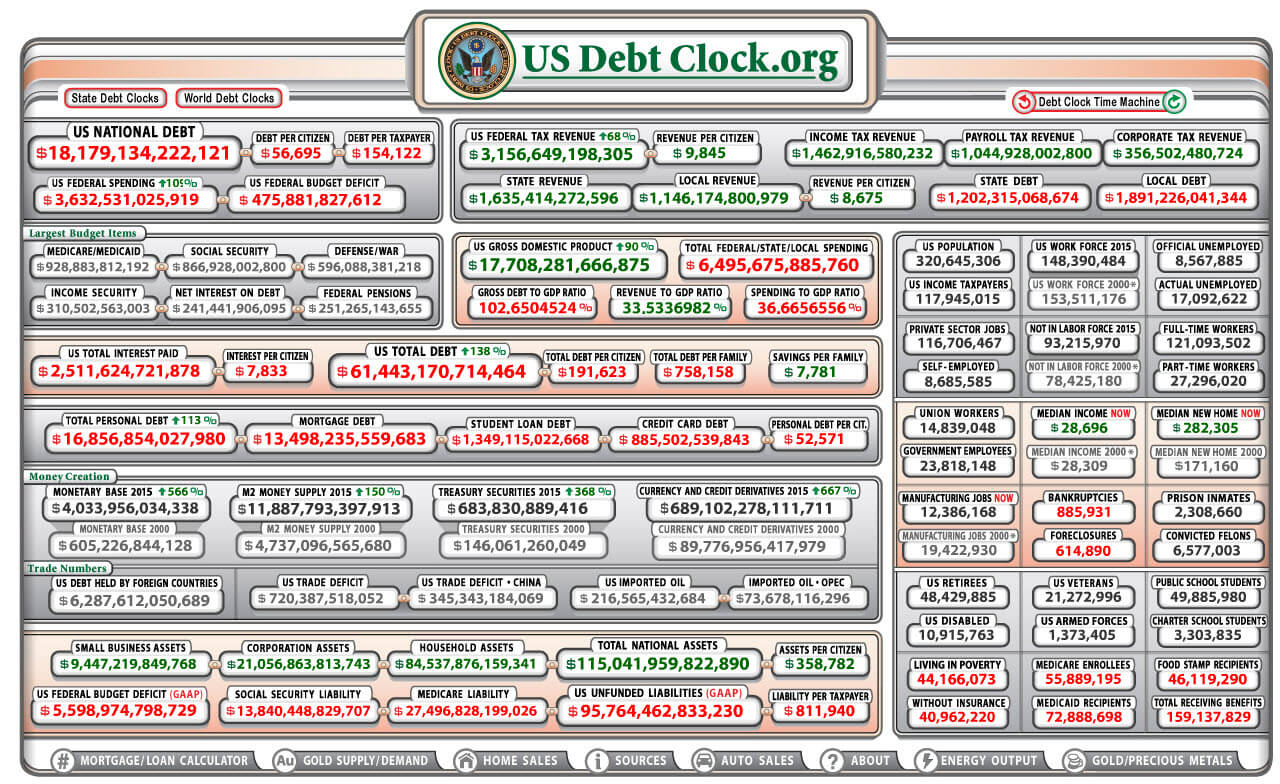

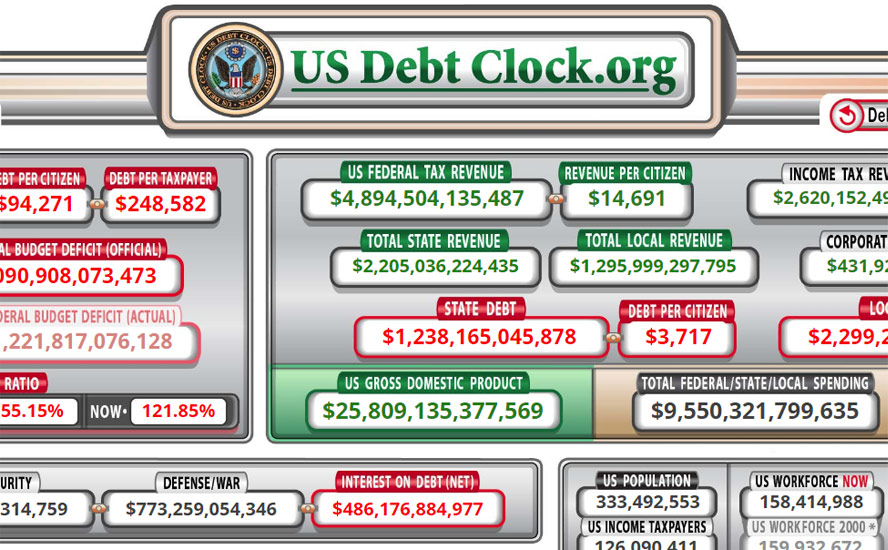

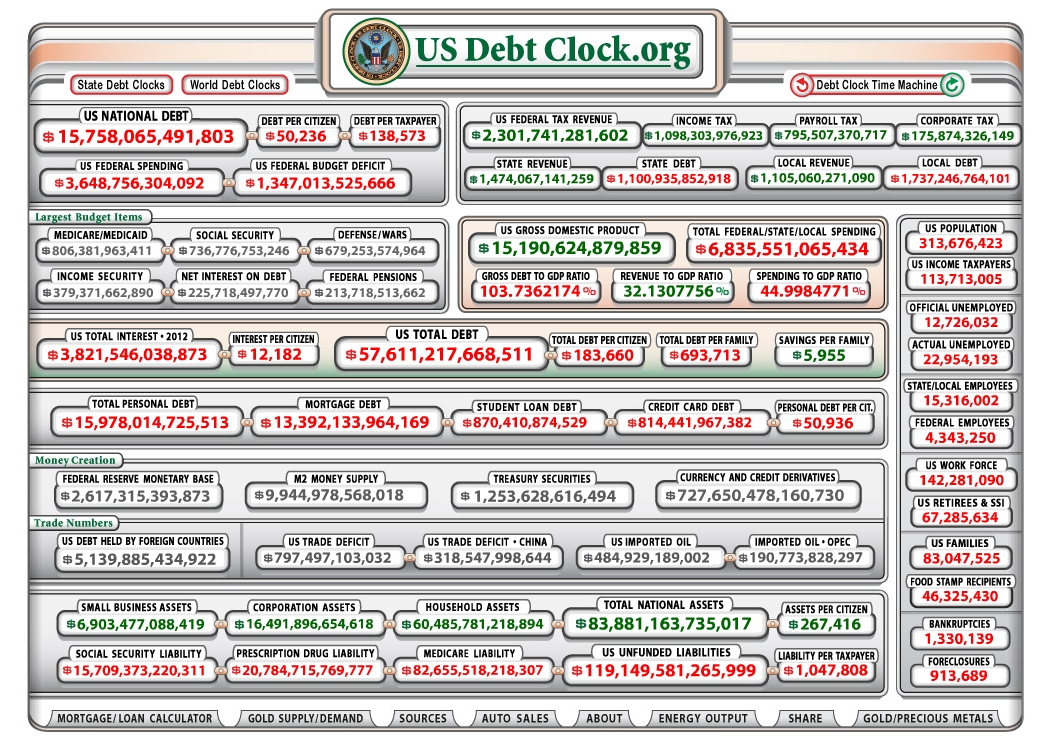

The US Dollar Debt Clock is a digital tool that tracks the total outstanding public debt of the United States in real-time. It provides a visual representation of the nation's financial obligations, allowing citizens and policymakers to monitor the growing debt levels. This clock is not just a number; it reflects the financial health of the country and the potential risks associated with excessive borrowing.

Key Features of the Debt Clock

- Real-time updates on the national debt.

- Breakdown of debt by category, such as Social Security, Medicare, and Defense spending.

- Comparison of debt levels across different administrations.

Understanding the mechanics of the US Dollar Debt Clock is crucial for anyone interested in the economic landscape of the United States. It serves as a transparent tool that holds the government accountable for its financial decisions.

History of the US National Debt

The history of the US National Debt dates back to the founding of the nation. Since the Revolutionary War, the US government has relied on borrowing to finance its operations. Over the years, significant events such as World War II, the Great Recession, and the COVID-19 pandemic have contributed to the exponential growth of the national debt.

Major Milestones in US Debt History

- 1945: Debt peaks at 113% of GDP due to World War II.

- 1980s: Debt begins to rise under President Reagan's tax cuts and increased military spending.

- 2008: The financial crisis leads to a surge in government borrowing.

- 2020: The pandemic results in unprecedented fiscal stimulus packages.

Each of these milestones highlights the cyclical nature of debt accumulation in response to economic challenges. By studying this history, we can better understand the current state of the US Dollar Debt Clock.

How the Debt Clock Works

The Debt Clock operates by aggregating data from various government sources, including the US Treasury Department. It calculates the total public debt by summing up the debt held by the public and intragovernmental holdings. This information is then displayed in real-time, providing an up-to-date snapshot of the nation's financial obligations.

Additionally, the Debt Clock often includes supplementary metrics such as:

Read also:Has George Clooney Won An Oscar A Comprehensive Look At His Awards Journey

- Per capita debt.

- Debt-to-GDP ratio.

- Projected future debt levels based on current trends.

These metrics offer a more comprehensive view of the nation's fiscal health and help policymakers make informed decisions about budgeting and spending.

Factors Contributing to the US Debt

Several factors have contributed to the growth of the US Dollar Debt Clock over the years. These include:

1. Government Spending

Increased government expenditures on social programs, defense, and infrastructure have driven up the national debt. For example, programs like Social Security and Medicare account for a significant portion of federal spending.

2. Tax Revenues

Fluctuations in tax revenues due to economic cycles and tax policy changes have impacted the government's ability to balance its budget. Tax cuts, while stimulating economic growth, often lead to short-term revenue shortfalls.

3. Economic Downturns

Recessions and economic crises necessitate increased government intervention, leading to higher borrowing. The 2008 financial crisis and the 2020 pandemic are prime examples of this phenomenon.

Addressing these factors requires a multifaceted approach that balances spending, taxation, and economic growth.

Economic Impact of the US Debt

The US Dollar Debt Clock has significant implications for the economy. High levels of debt can lead to:

1. Increased Interest Rates

As the government borrows more, it competes with private sector borrowers for funds, potentially driving up interest rates. This can stifle investment and slow economic growth.

2. Inflationary Pressures

Excessive debt can lead to inflation if the government resorts to printing money to finance its obligations. This erodes purchasing power and reduces the value of savings.

3. Reduced Fiscal Flexibility

A high debt burden limits the government's ability to respond to future economic challenges. Policymakers may be constrained in their ability to implement stimulus measures during recessions.

Understanding these impacts is essential for assessing the long-term sustainability of the US fiscal policy.

Global Perspective on US Debt

The US Dollar Debt Clock is not just a domestic issue; it has global ramifications. As the world's largest economy, the financial health of the United States affects global markets and trade. Key considerations include:

1. Currency Stability

The US dollar's status as a global reserve currency means that its value is closely tied to the nation's debt levels. A weakening dollar could impact international trade and investment.

2. Sovereign Debt Ratings

Credit rating agencies monitor the US debt levels and may downgrade the country's credit rating if they perceive a heightened risk of default. This can increase borrowing costs for the government.

3. Global Investment Flows

Investors worldwide rely on US Treasury securities as a safe haven asset. However, excessive debt may lead to reduced confidence in these instruments, affecting global capital flows.

These global dimensions underscore the importance of managing the US debt responsibly.

Solutions to Manage US Debt

Addressing the challenges posed by the US Dollar Debt Clock requires a combination of short-term and long-term solutions. Some potential strategies include:

1. Fiscal Responsibility

Implementing stricter budget controls and reducing wasteful spending can help curb the growth of the national debt.

2. Economic Growth

Promoting policies that foster economic growth can increase tax revenues and reduce the debt-to-GDP ratio over time.

3. Tax Reform

Reforming the tax system to ensure fairness and efficiency can enhance the government's revenue-generating capacity.

These solutions require bipartisan cooperation and a commitment to long-term fiscal sustainability.

US Debt and Inflation

The relationship between US debt and inflation is complex. While moderate levels of debt can stimulate economic growth, excessive borrowing may lead to inflationary pressures. Key factors to consider include:

1. Money Supply

Increased government borrowing can lead to an expansion of the money supply, which may result in inflation if not managed properly.

2. Interest Rates

Higher debt levels may force the Federal Reserve to raise interest rates to control inflation, impacting borrowing costs for consumers and businesses.

3. Consumer Confidence

Persistent inflation can erode consumer confidence, leading to reduced spending and economic contraction.

Managing this delicate balance is critical for maintaining economic stability.

Future Prospects of US Debt

The future of the US Dollar Debt Clock depends on a variety of factors, including economic conditions, political decisions, and global developments. Some potential scenarios include:

1. Continued Growth

If current trends persist, the national debt is likely to continue growing, posing significant challenges for future generations.

2. Debt Stabilization

Implementing effective fiscal policies could stabilize the debt levels, reducing the risk of economic instability.

3. Debt Reduction

While challenging, achieving a reduction in the national debt through economic growth and prudent fiscal management is not impossible.

Exploring these scenarios can help policymakers and citizens prepare for the future.

Conclusion and Next Steps

The US Dollar Debt Clock serves as a critical tool for monitoring the financial health of the United States. By understanding its history, causes, and implications, we can better appreciate the challenges and opportunities associated with managing the national debt.

As we move forward, it is essential to engage in constructive dialogue about fiscal policy and work towards solutions that ensure long-term economic stability. We encourage readers to:

- Share this article with others to raise awareness about the US debt.

- Explore additional resources for further information on economic topics.

- Engage with policymakers to advocate for responsible fiscal management.

Together, we can contribute to a more sustainable economic future for all.

Data Source: US Treasury Department, Federal Reserve, International Monetary Fund.