When it comes to navigating the complexities of the U.S. tax system, the IRS help line serves as a vital resource for individuals and businesses alike. Whether you're dealing with tax filings, audits, penalties, or any other tax-related issue, understanding how the IRS help line works can make all the difference. This guide aims to provide you with detailed insights into the IRS assistance programs, contact methods, and tips for resolving your tax-related concerns efficiently.

The IRS help line is more than just a phone number; it's a lifeline for taxpayers seeking clarity, guidance, and support. In this article, we will explore everything you need to know about the IRS help line, including how to contact them, the types of assistance available, and strategies to maximize your experience with IRS customer service.

As tax obligations continue to evolve, staying informed and connected with IRS resources becomes increasingly important. This article will serve as a comprehensive reference to ensure you have the right tools and information at your disposal when interacting with the IRS. Let's dive into the details.

Read also:2003 Is The Year Of What Animal Unveiling The Symbolic Zodiac Sign

Understanding the IRS Help Line and Its Importance

The IRS help line is an essential service provided by the Internal Revenue Service to assist taxpayers with their inquiries and issues. It plays a crucial role in helping individuals and businesses navigate the complexities of federal tax laws. Whether you're looking for clarification on tax forms, seeking assistance with back taxes, or addressing a tax lien, the IRS help line can provide the support you need.

One of the primary advantages of the IRS help line is its accessibility. Taxpayers can reach out via phone, email, or even in-person visits to IRS offices. This flexibility ensures that everyone has the opportunity to seek help regardless of their location or circumstances. Additionally, the IRS help line offers multilingual support, making it easier for non-native English speakers to communicate effectively.

Key Benefits of the IRS Help Line

- 24/7 availability for certain services

- Expert assistance from IRS agents

- Support for a wide range of tax-related issues

- Multilingual support for diverse populations

- Free and confidential assistance

How to Contact the IRS Help Line

Contacting the IRS help line is straightforward, but it's important to choose the right method based on your specific needs. The IRS offers several ways to reach out, including phone calls, online forms, and in-person visits. Below, we outline the most common methods:

Phone Support

One of the most popular ways to contact the IRS help line is through their toll-free phone number: (800) 829-1040. This number is available Monday through Friday, from 7 a.m. to 7 p.m. local time. When calling, be prepared to provide personal information such as your Social Security Number (SSN) or Employer Identification Number (EIN) to verify your identity.

Live Chat

For those who prefer a more interactive experience, the IRS offers live chat support through their official website. This option is particularly useful for resolving straightforward questions and issues. To access live chat, visit the IRS website and navigate to the "Contact Us" section.

In-Person Assistance

If you prefer face-to-face interaction, the IRS operates Taxpayer Assistance Centers (TACs) across the United States. These centers provide personalized support for complex tax issues. To find the nearest TAC, use the IRS locator tool on their website.

Read also:Judith Harper From Two And A Half Men An Indepth Exploration

Common Issues Addressed by the IRS Help Line

The IRS help line addresses a wide range of tax-related issues, from simple inquiries to complex disputes. Below, we highlight some of the most common topics taxpayers seek assistance with:

Tax Filing Assistance

Many taxpayers turn to the IRS help line for guidance on completing their tax returns. Whether you're unsure about deductions, credits, or specific forms, IRS agents can provide step-by-step instructions to ensure accuracy.

Audit Support

Being audited by the IRS can be a stressful experience. The IRS help line offers support throughout the audit process, helping taxpayers understand their rights and obligations. Agents can also clarify documentation requirements and provide advice on how to respond to audit notices.

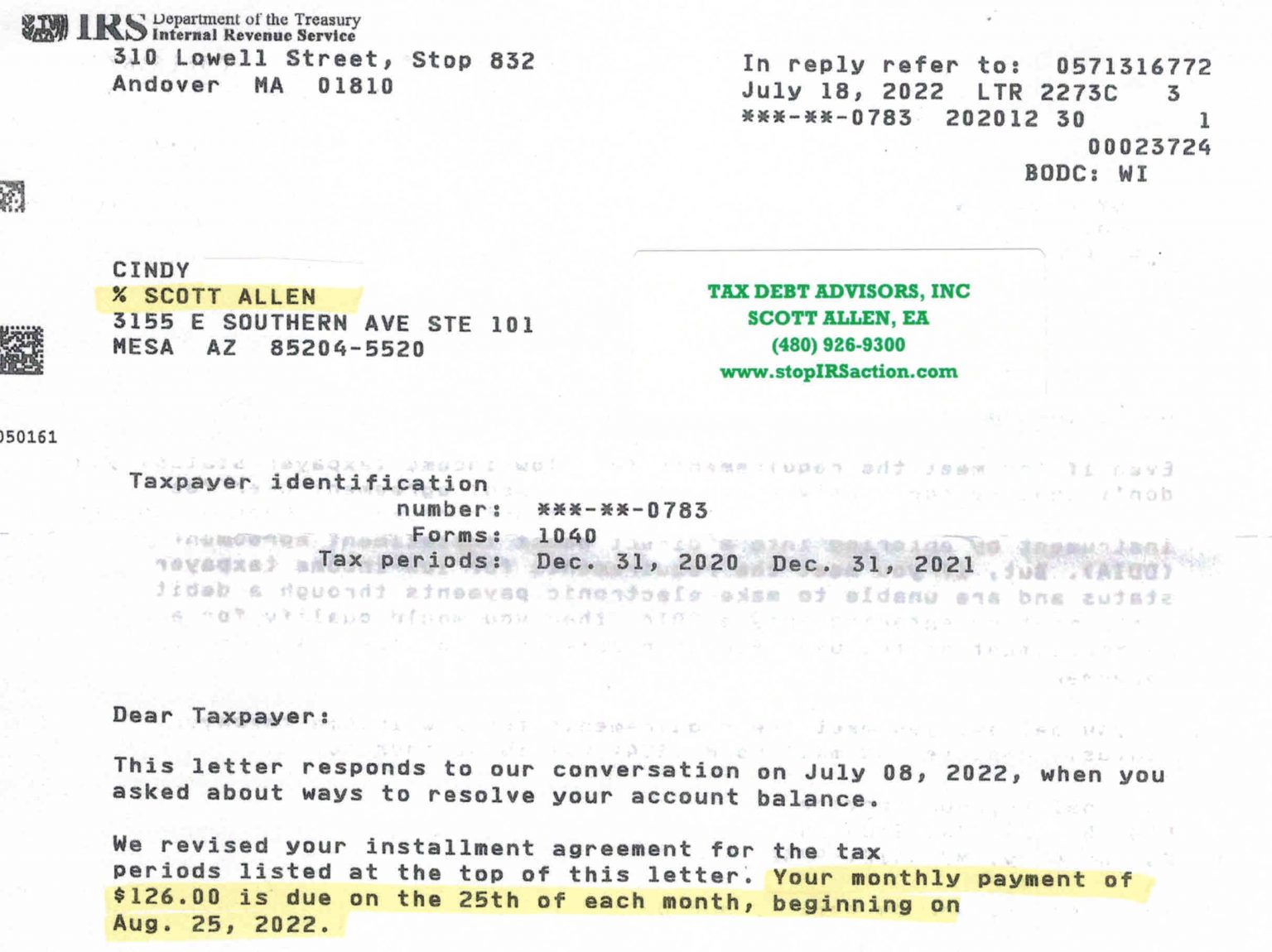

Payment Plans and Settlements

If you owe back taxes, the IRS help line can assist you in setting up payment plans or negotiating settlements. Options such as Installment Agreements and Offers in Compromise are available to help taxpayers manage their financial obligations.

Maximizing Your Experience with the IRS Help Line

To get the most out of your interaction with the IRS help line, it's essential to prepare thoroughly and communicate effectively. Below are some tips to enhance your experience:

Prepare Your Documents

Before reaching out to the IRS help line, gather all relevant documents, including tax returns, W-2s, 1099s, and any correspondence from the IRS. Having this information readily available will streamline the process and ensure accurate assistance.

Know Your Rights

Familiarize yourself with your taxpayer rights, as outlined in the IRS Taxpayer Bill of Rights. This knowledge empowers you to advocate for yourself during interactions with IRS agents.

Be Patient and Polite

IRS agents handle a high volume of calls and inquiries, so patience is key. Maintain a polite and respectful tone throughout your conversation to foster productive communication.

Understanding IRS Assistance Programs

The IRS offers various programs designed to assist taxpayers in specific situations. These programs aim to provide relief and support for those facing financial hardship or unique circumstances. Below are some notable examples:

Low Income Taxpayer Clinic (LITC)

The LITC program provides free legal assistance to low-income taxpayers involved in tax disputes with the IRS. This service is particularly valuable for individuals who cannot afford legal representation.

First Time Penalty Abatement

If you receive a penalty for the first time due to a minor mistake, the IRS may waive it under the First Time Penalty Abatement program. This initiative encourages compliance while offering leniency for honest errors.

Offer in Compromise

For taxpayers who cannot pay their full tax debt, the Offer in Compromise program allows them to settle their obligation for less than the total amount owed. Eligibility depends on various factors, including income and assets.

Statistical Insights into IRS Help Line Usage

According to recent data, millions of taxpayers rely on the IRS help line each year. In 2022 alone, the IRS received over 100 million calls, with a resolution rate of approximately 70%. These statistics underscore the importance of the IRS help line as a critical resource for tax assistance.

Additionally, the IRS has made significant improvements in recent years to enhance customer service. For instance, the implementation of automated systems and expanded live chat options has reduced wait times and improved accessibility for taxpayers.

Expert Tips for Navigating the IRS System

Interacting with the IRS can be daunting, but with the right strategies, you can navigate the system successfully. Below are some expert tips to guide you:

Keep Detailed Records

Maintain thorough records of all communications with the IRS, including dates, times, and agent names. These records can be invaluable if disputes arise or if you need to reference past interactions.

Seek Professional Help When Needed

If your tax issue is complex or involves significant financial implications, consider consulting a tax professional. Certified Public Accountants (CPAs) and Enrolled Agents (EAs) specialize in IRS matters and can provide expert guidance.

Stay Informed

Regularly check the IRS website for updates on laws, regulations, and assistance programs. Staying informed ensures you're aware of any changes that may impact your tax situation.

Addressing Common Misconceptions About the IRS Help Line

There are several misconceptions about the IRS help line that can deter taxpayers from seeking assistance. Below, we address some of these myths:

Myth: The IRS Help Line is Only for Serious Issues

Reality: The IRS help line is available for all types of tax-related inquiries, from simple questions to complex disputes. Don't hesitate to reach out for clarification on even the smallest issue.

Myth: IRS Agents are Unhelpful

Reality: While wait times can be long, IRS agents are trained to provide accurate and compassionate assistance. Many taxpayers report positive experiences when interacting with the IRS help line.

Conclusion and Call to Action

In conclusion, the IRS help line is an invaluable resource for taxpayers seeking guidance and support with their tax obligations. By understanding how to contact the IRS, preparing effectively, and leveraging available programs, you can resolve your tax issues efficiently and confidently.

We encourage you to share this article with others who may benefit from its insights. Additionally, if you have any questions or feedback, please leave a comment below. Together, we can build a community of informed taxpayers who navigate the IRS system with ease and success.

Table of Contents

- Understanding the IRS Help Line and Its Importance

- How to Contact the IRS Help Line

- Common Issues Addressed by the IRS Help Line

- Maximizing Your Experience with the IRS Help Line

- Understanding IRS Assistance Programs

- Statistical Insights into IRS Help Line Usage

- Expert Tips for Navigating the IRS System

- Addressing Common Misconceptions About the IRS Help Line

- Conclusion and Call to Action