ABA numbers, also known as American Bankers Association routing numbers, play a pivotal role in the banking system of the United States. These numbers ensure that transactions are routed to the correct financial institution, making them indispensable for both personal and business banking needs. Understanding what ABA numbers are and how they work can help you manage your finances more effectively and avoid potential errors in transactions.

In today's digital age, where financial transactions are increasingly done online, knowing the details about ABA numbers is more important than ever. Whether you're setting up direct deposits, paying bills online, or transferring funds between accounts, ABA numbers are at the heart of ensuring these processes run smoothly.

This article will provide an in-depth explanation of ABA numbers, their purpose, and how they function. We'll also cover common questions, best practices, and tips for ensuring your banking transactions are accurate and secure. By the end of this guide, you'll have a comprehensive understanding of ABA numbers and their significance in the banking world.

Read also:Has George Clooney Won An Oscar A Comprehensive Look At His Awards Journey

Table of Contents

- ABA Numbers: The Basics

- The History of ABA Numbers

- Structure of an ABA Number

- Common Uses of ABA Numbers

- How to Find Your ABA Number

- ABA Numbers vs. Other Identifiers

- Security Concerns with ABA Numbers

- Frequently Asked Questions About ABA Numbers

- Regulations and Compliance for ABA Numbers

- The Future of ABA Numbers

ABA Numbers: The Basics

ABA numbers are nine-digit codes assigned to financial institutions in the United States. These numbers identify the specific bank or credit union involved in a transaction, ensuring that funds are routed to the correct location. They are primarily used for domestic transactions within the U.S.

Why Are ABA Numbers Important?

ABA numbers are crucial for several reasons:

- They ensure accurate routing of funds between banks.

- They help prevent fraud by verifying the legitimacy of financial institutions.

- They streamline the processing of checks, direct deposits, and electronic payments.

Without ABA numbers, the banking system would face significant challenges in processing transactions efficiently and securely.

The History of ABA Numbers

The concept of ABA numbers was introduced in 1910 by the American Bankers Association as a way to standardize the routing of checks between banks. At the time, the banking industry was expanding rapidly, and there was a growing need for a reliable system to manage the increasing volume of transactions.

Read also:Jacksonville Jaguars Backup Quarterback A Comprehensive Analysis

Evolution Over Time

Over the decades, ABA numbers have evolved to accommodate new technologies and transaction methods. Initially designed for check processing, they are now used for electronic transfers, direct deposits, and other modern banking services. The Federal Reserve also plays a key role in regulating and maintaining the ABA number system.

Structure of an ABA Number

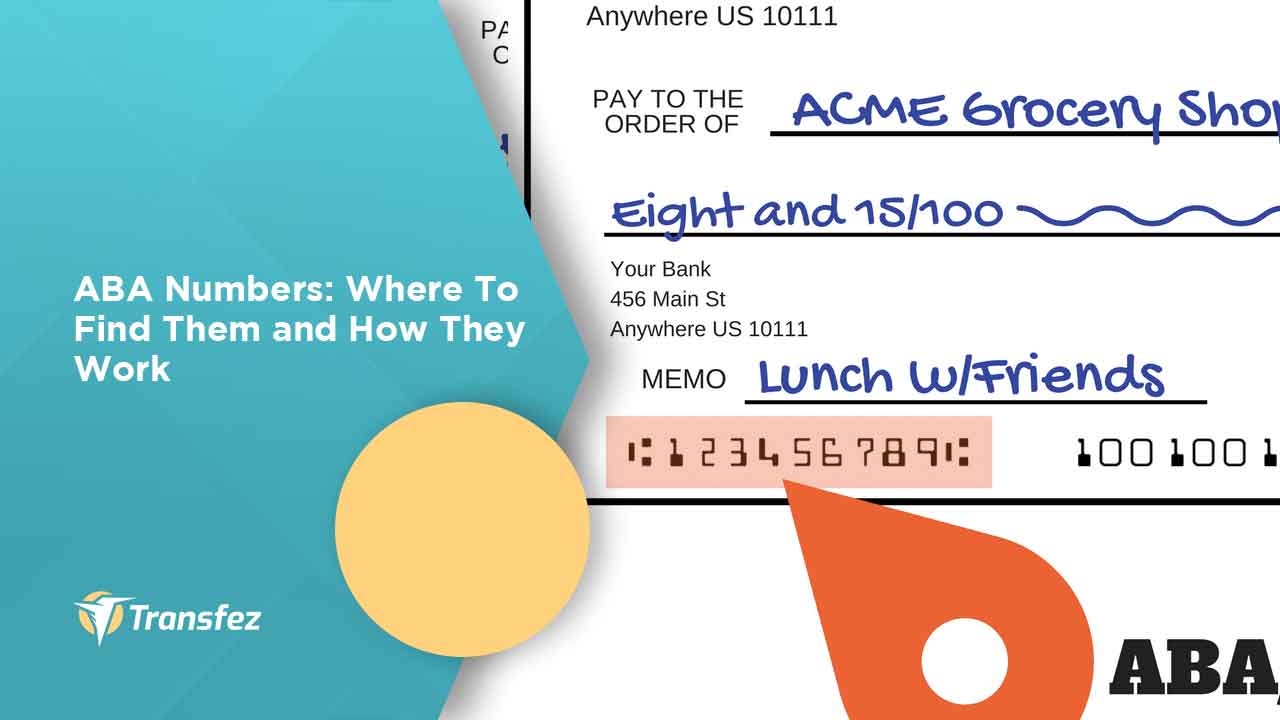

An ABA number consists of nine digits, each with a specific purpose:

- First four digits: Represent the Federal Reserve routing symbol.

- Next four digits: Identify the specific financial institution.

- Last digit: Acts as a checksum to verify the accuracy of the number.

How to Validate an ABA Number

To ensure the validity of an ABA number, you can use the checksum formula. This involves multiplying each digit by a specific weight and verifying that the result meets the required criteria. Many online tools are available to assist with this process.

Common Uses of ABA Numbers

ABA numbers are used in various banking transactions, including:

- Direct deposits: Ensuring payroll checks and government benefits are deposited into the correct account.

- Check processing: Facilitating the clearance of paper checks.

- Electronic funds transfers (EFT): Allowing for seamless transfers between accounts.

Benefits of Using ABA Numbers

Using ABA numbers provides several advantages, such as:

- Increased efficiency in processing transactions.

- Reduced risk of errors in fund routing.

- Enhanced security through standardized identification.

How to Find Your ABA Number

Locating your ABA number is straightforward. Here are some common methods:

- Checkbook: The ABA number is typically printed at the bottom of your checks, usually as the first set of numbers.

- Online banking: Most banks provide ABA numbers in the account information section of their websites or mobile apps.

- Bank statement: Your ABA number may also appear on your monthly bank statement.

Tips for Identifying the Correct ABA Number

It's important to confirm that you're using the correct ABA number for your specific transaction. Some banks may have multiple ABA numbers for different purposes, such as wire transfers versus direct deposits. Always double-check the number with your bank if you're unsure.

ABA Numbers vs. Other Identifiers

While ABA numbers are widely used in the U.S., other countries and regions may use different systems for routing transactions. For example:

- SWIFT codes: Used for international wire transfers.

- IBAN numbers: Commonly used in Europe for cross-border transactions.

Comparing ABA Numbers to SWIFT Codes

ABA numbers and SWIFT codes serve similar purposes but are used in different contexts. ABA numbers are specific to domestic transactions within the U.S., while SWIFT codes facilitate international transfers. Understanding the distinction is essential for global banking activities.

Security Concerns with ABA Numbers

Although ABA numbers are designed to enhance security, they can still be vulnerable to misuse if not handled properly. Here are some best practices for protecting your ABA number:

- Keep it confidential: Avoid sharing your ABA number unnecessarily.

- Monitor transactions: Regularly review your bank statements for any suspicious activity.

- Use secure channels: When providing your ABA number online, ensure the website is legitimate and encrypted.

What to Do If Your ABA Number Is Compromised

If you suspect that your ABA number has been compromised, contact your bank immediately. They can help you take steps to protect your account and prevent unauthorized transactions.

Frequently Asked Questions About ABA Numbers

Here are some common questions about ABA numbers:

- What happens if I use the wrong ABA number? Incorrect ABA numbers can result in delayed or failed transactions, so it's important to double-check the number before proceeding.

- Can I use the same ABA number for different types of transactions? It depends on your bank. Some banks have different ABA numbers for wire transfers and direct deposits, so always verify with your financial institution.

- Are ABA numbers unique to each bank? Yes, each financial institution in the U.S. has its own unique ABA number.

Regulations and Compliance for ABA Numbers

The use of ABA numbers is governed by federal regulations to ensure consistency and security across the banking industry. Key regulatory bodies include:

- Federal Reserve: Oversees the routing and processing of transactions.

- American Bankers Association: Maintains the standards and guidelines for ABA numbers.

How Regulations Protect Consumers

These regulations help protect consumers by ensuring that ABA numbers are used correctly and securely. They also provide a framework for addressing disputes and resolving issues related to transactions.

The Future of ABA Numbers

As technology continues to evolve, the role of ABA numbers in the banking system may change. Emerging trends, such as blockchain and digital currencies, could influence how transactions are routed and verified. However, ABA numbers are likely to remain a fundamental component of the U.S. banking infrastructure for the foreseeable future.

Adapting to New Technologies

Financial institutions will need to adapt to new technologies while maintaining the integrity and security of the ABA number system. This may involve integrating advanced encryption methods and adopting new standards for digital transactions.

Conclusion

In summary, ABA numbers are a critical component of the U.S. banking system, ensuring accurate and secure routing of transactions. Understanding their structure, uses, and security considerations can help you manage your finances more effectively and avoid potential issues.

We encourage you to share this article with others who may benefit from learning about ABA numbers. If you have any questions or feedback, please leave a comment below. Additionally, explore our other articles for more insights into personal finance and banking.

Remember: Always verify your ABA number with your bank to ensure accuracy and security in your transactions.